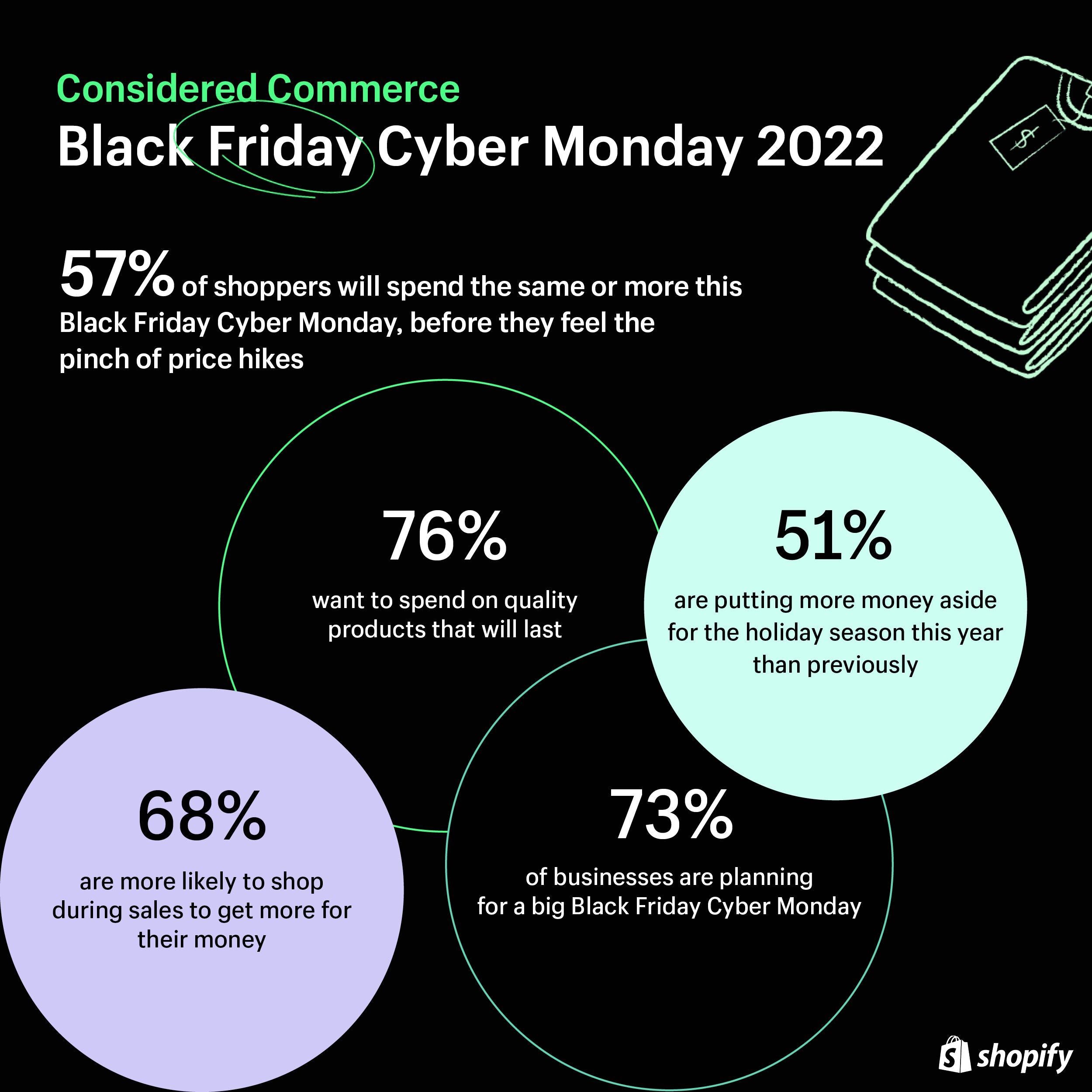

Shopify’s new Black Friday Cyber Monday global research survey reveals shoppers are looking for products that last, businesses are looking to connect with customers across more channels, climate-conscious shopping is growing on a mass scale, and brand loyalty is up for grabs

- 73% of businesses worldwide are planning for a big Black Friday Cyber Monday weekend this year, despite economic uncertainty

- 76% of shoppers globally are looking to spend on quality items that last

- 40% of consumers will pay more for climate-conscious products

A changing economic environment means a new shape for commerce—from high volume and low prices, to value that lasts. As we gear up for the 2022 Black Friday Cyber Monday (BFCM) weekend—an event that last year saw 47 million+ shoppers buying from independent brands powered by Shopify—we surveyed more than 24,000 consumers and 9,000 small and medium businesses around the world to learn how cost-of-living spikes are affecting spending habits and retailers worldwide*.

What we heard, loud and clear, is that businesses and shoppers plan to be more considered, conscious, and connected this holiday shopping season.

Expect more intentional spending; more climate-conscious shoppers seeking out brands with sustainable practices; and businesses planning for a big BFCM weekend, selling to their customers across multiple surfaces - from social media to in-store and everywhere in between.

“Black Friday Cyber Monday is more than just a weekend–it’s a season. It is without a doubt the biggest commerce event of the year. I’ve said this before: modern retailers need to sell wherever their customers spend time–online, offline, and everywhere in between,” said Harley Finkelstein, President of Shopify. “If you’ve built a community and a direct relationship with your customers, you’ll also secure their loyalty. Consumers are voting with their wallets to support the brands they love that reflect their values.”

CONSIDERED

Shoppers are looking for quality that lasts

Consumers’ motto this year? Quality over quantity. Three in four consumers (76%) we surveyed want to spend on higher-quality products that will last. While three in four (75%) have also reduced their spending in the last couple of months, more than half (57%) of consumers said they’ll spend as much or more this BFCM than last year. That’s a strong signal for businesses worldwide, as our data suggests 75% of them are planning to offer better deals this BFCM weekend.

“Taylor Morris sells luxury eyewear, but we pride ourselves on being accessible. Getting the offer right has never been more important. We’re exploring new ways customers can buy into our brand in a budget-friendly way, like offering prescription glasses on subscription or adding more support services,” said Nicholas Dellaportas, founder of Taylor Morris Eyewear in the U.K. “When a customer’s prescription changes, we’re adding more options to adapt their existing lenses instead of them buying a whole new pair.” Good for the budget; good for the planet.

Consumers are feeling the squeeze, but are still treating themselves every month

Consumers are feeling the squeeze on their wallets this year, and it’s showing in how they’re prioritizing their spend. Most shoppers (84%) we surveyed said they’ll compare prices before they buy. Millennials are the keenest bargain hunters—77% said they’re more likely to shop sales to get the most for their money. And 65% of Gen Z consumers will set more money aside this year, as they plan for a festive holiday season.

Two thirds of shoppers (67%) also told us that despite this pinch, they’re still planning to treat themselves each month. And 69% are looking to spend on smaller purchases that bring them joy, marking an opportunity for businesses whose products offer everyday delight in uncertain times.

To learn more about the rise of considered shopping this year, check out our first BFCM Trend Reports here.

CONSCIOUS

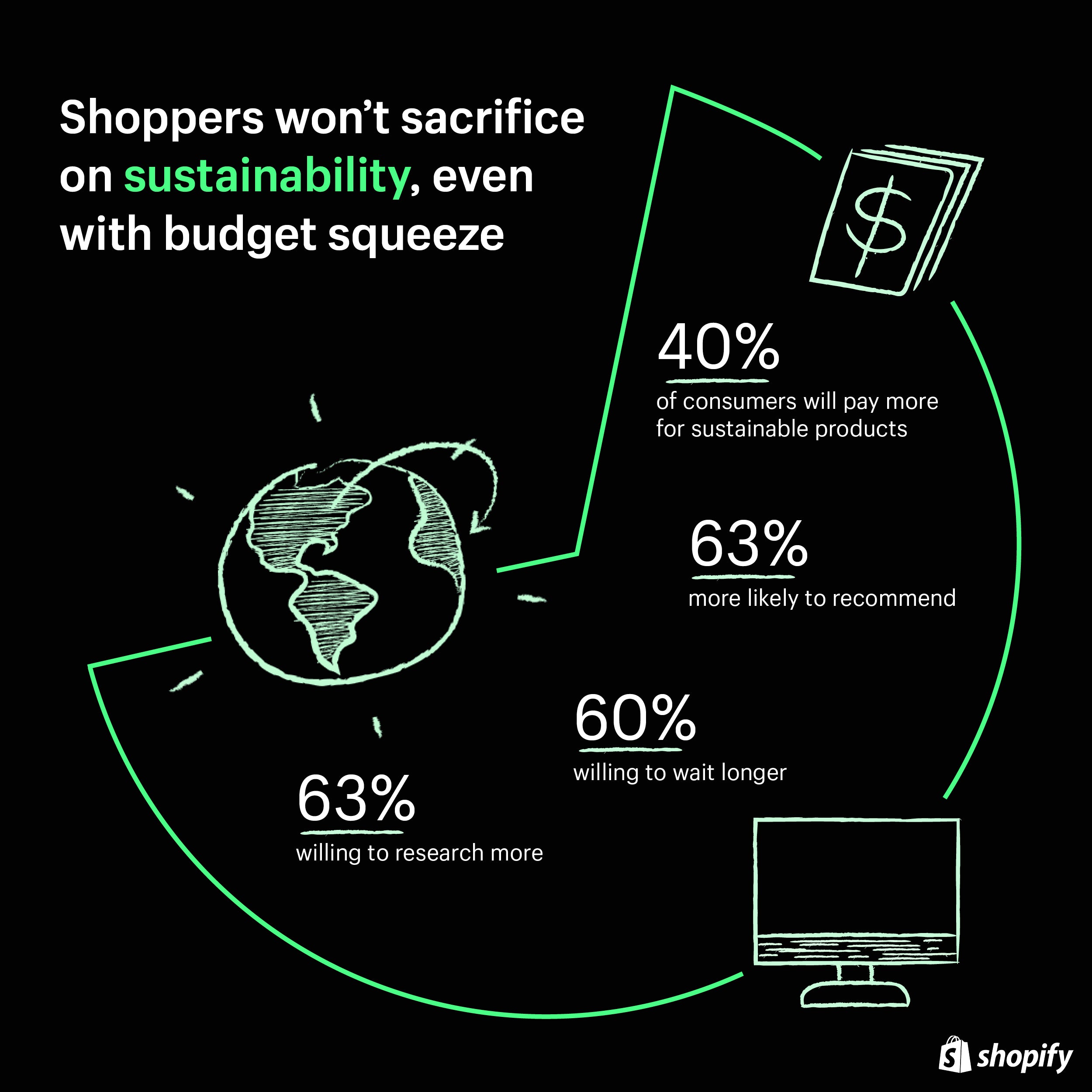

Consumers won’t compromise on sustainability, as word-of-mouth drives demand for climate-conscious products

One thing consumers aren’t willing to budge on, despite the bills biting this year, is sustainability. Globally, two of every five shoppers (40%) we surveyed are willing to pay extra for climate-conscious products. Even more of them (43%) say they’re more likely to buy from brands with sustainability practices, such as carbon-neutral shipping or taking a “low or no waste” approach.

A bonus for retailers who offer climate-conscious items? Word-of-mouth. Three in five customers (63%) are more likely to recommend a product if they know it’s less harmful to the environment. Shoppers (63%) are also putting more effort than ever into researching which brands are keeping their promises when it comes to the climate crisis, prioritizing products with recyclable packaging and buying local to reduce their environmental impact.

Shoppers will pay more and wait longer if it means reducing their carbon footprint

While some surveyed businesses (42%) say the cost of adopting sustainable practices is still a major hurdle, and a quarter (26%) worry it would mean delivery delays, our data suggests the outlay is worth it. Many shoppers (60%) are willing to wait longer for their products to arrive–and some (45%) will even pay a bit more to reduce their carbon footprint. While spending more to waste less might affect delivery times, most businesses (79%) say surging inflation won’t derail their sustainability efforts.

"Our customers understand that if they want sustainable clothing that lasts, they may pay a little more in the short-term for long-term benefit. People understand that current fast fashion practices are unsustainable, so they trust us even when budgets are tight,” said Lutz Schwenke, Founder and CEO of TwoThirds, a sustainable fashion brand based in Spain. “We also have some great sales, which reward our customers and keep overproduction rates to a minimum, something that’s critical to us remaining a climate-neutral brand.”

For more on the rise of conscious shopping, read our second BFCM Trend Reports here.

CONNECTED

Customers are ready to connect with new brands in-store, online, and everywhere in between

Connecting to consumers remains a massive opportunity for merchants this year, as customers look online, offline, and everywhere in between to shop their favorite brands. And social commerce continues to surge in popularity: Nearly half of the GenZers we surveyed (44%) said they’d probably make a purchase via TikTok, and many (43%) agreed they’d buy via YouTube, two places our merchants can sell seamlessly.

Businesses are responding to the trend, with most (81%) telling us that social commerce is just as important, if not more, than it was last year.

Consumers are looking to invest their money – and loyalty – with rivals if it means higher quality

After an uncertain year, consumers are open to change and new connections. They’re dedicating more time to looking for higher quality products when it comes to investing their money–and their loyalty. Nearly half (46%) would go elsewhere for a higher-quality product, and a quarter (26%) can be won by future discounts.

For merchants, that means having a direct relationship with consumers is more important than ever. Two thirds (65%) of global consumers we surveyed would switch to a rival brand if it meant saving money. The good news? Two thirds (68%) of shoppers also want to hear what offers businesses have in store this BFCM, meaning there are millions of connections just waiting to be made, all around the world.

And speaking of 🌎, Shopify’s annual BFCM Live Globe launches on Black Friday, capturing global commerce in real time across Shopify-powered businesses. Happy shopping.

*Online survey conducted by Sapio Research, on behalf of Shopify, from 24,009 consumers and 9,012 businesses with fewer than 1,000 employees across the U.K., France, Germany, Spain, Italy, Netherlands, Sweden, Australia, New Zealand, Japan, the U.S., and Canada. The survey took place between September and October 2022.