Fourth-Quarter Revenue Grows 94% on GMV Growth of 99% Year on Year

Full-Year 2020 Revenue Grows 86% on GMV Growth of 96% Year on Year

GMV Exceeds $41 Billion for the Fourth Quarter and Reaches $120 Billion for 2020

Shopify reports in U.S. dollars and in accordance with U.S. GAAP

The Internet - February 17, 2021 - Shopify Inc. (NYSE:SHOP)(TSX:SHOP), a leading global commerce company, announced today strong financial results for the fourth quarter and full year ended December 31, 2020.

“The spirit of entrepreneurship was strong in 2020, as our merchants’ resilience and ability to adapt helped many of them thrive in a difficult year,” said Harley Finkelstein, Shopify’s President. “Shopify is at the heart of our merchants’ businesses with entrepreneurs around the world trusting us with their livelihoods. This year, we are doubling down on creating a frictionless path to successful entrepreneurship, as we continue to build a future-proof commerce solution to serve generations to come.”

“Our fourth-quarter results capped off an outstanding 2020, thanks to the success of our merchants in a year that truly tested their mettle and triggered more entrepreneurs around the world to start their journey toward economic independence,” said Amy Shapero, Shopify’s CFO. “Shopify was prepared to ship the features that our merchants needed during the pandemic because we had invested for several years in a future that arrived early with the acceleration of online commerce. We’re amplifying our efforts in 2021, as we focus on executing on a portfolio of initiatives that will fuel further growth for our merchants and for Shopify.”

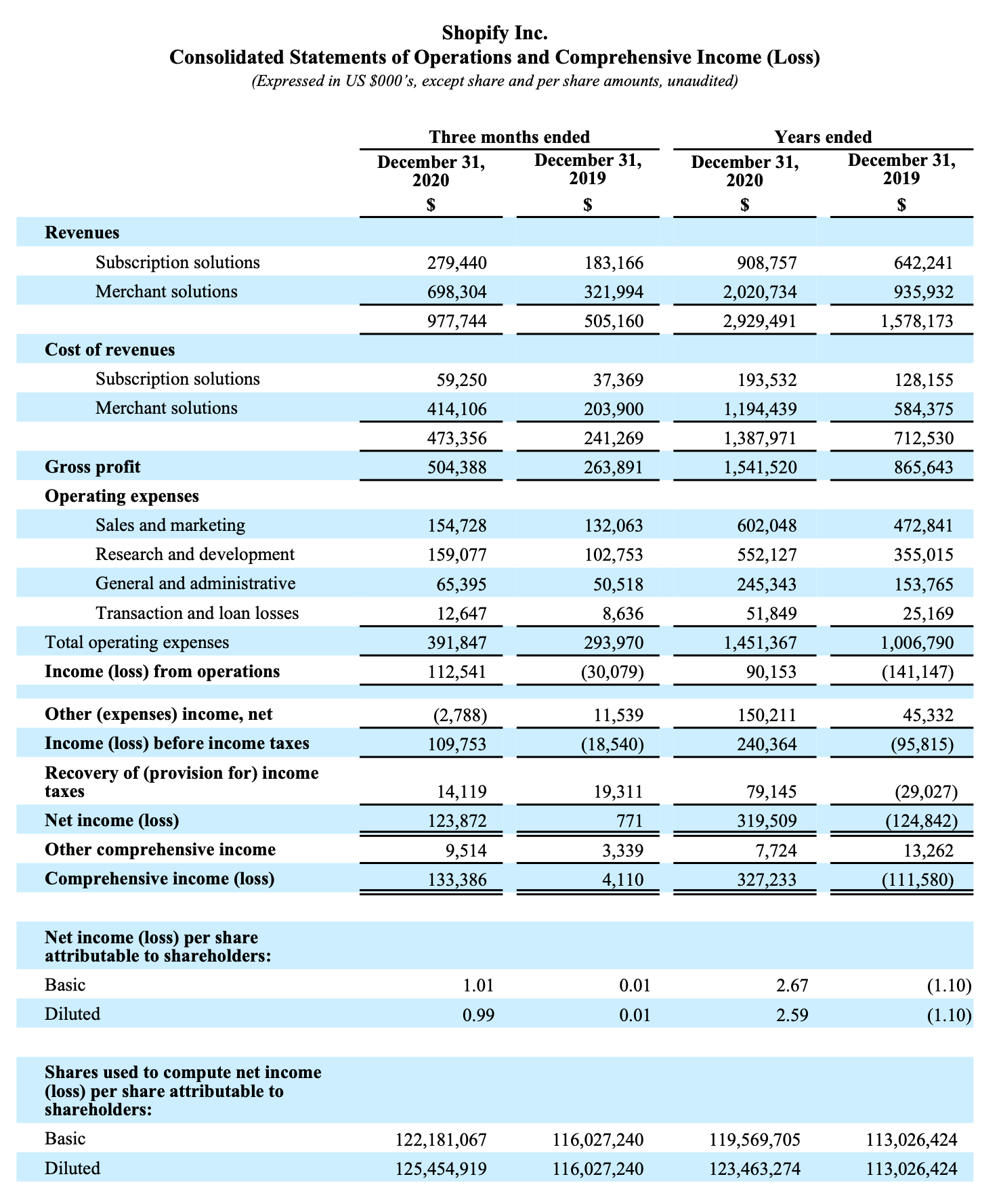

Fourth-Quarter Financial Highlights

- Total revenue in the fourth quarter was $977.7 million, a 94% increase from the comparable quarter in 2019.

- Subscription Solutions revenue was $279.4 million, up 53% year over year, primarily due to more merchants joining the platform.

- Merchant Solutions revenue growth increased 117%, to $698.3 million, driven primarily by the growth of Gross Merchandise Volume1 ("GMV").

- Monthly Recurring Revenue2 ("MRR") as of December 31, 2020 was $82.6 million. Growth accelerated to 53% year-over-year with MRR up from $53.9 million as of December 31, 2019 due to the continued high number of new merchants joining the platform in the quarter following record merchant additions in the third quarter. Q4 2020 MRR also benefited from incremental new revenue from our Retail POS Pro subscription offering, as subscription pricing came into effect in November 2020. Shopify Plus contributed $21.0 million, or 25%, of MRR compared with 27% of MRR as of December 31, 2019 as a result of the significantly higher number of merchants on standard plans joining the platform in 2020.

- GMV for the fourth quarter was $41.1 billion, an increase of $20.5 billion, or 99% over the fourth quarter of 2019. Gross Payments Volume3 ("GPV") grew to $19.1 billion, which accounted for 46% of GMV processed in the quarter, versus $8.9 billion, or 43%, for the fourth quarter of 2019.

- Gross profit dollars grew 91% to $504.4 million in the fourth quarter of 2020, compared with $263.9 million for the fourth quarter of 2019.

- Adjusted gross profit4 grew 89% to $510.6 million in the fourth quarter of 2020, compared with $269.9 million for the fourth quarter of 2019.

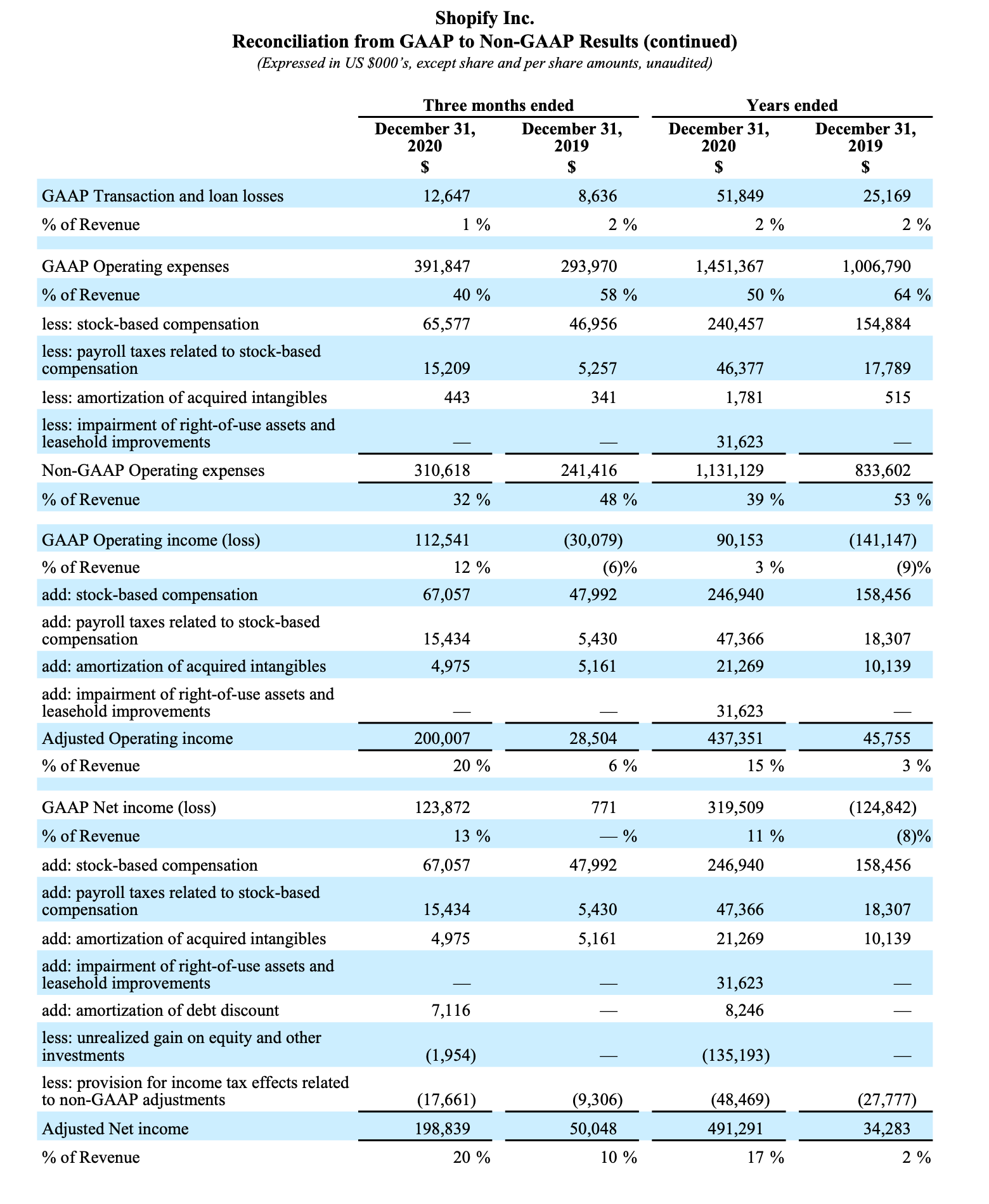

- Operating income for the fourth quarter of 2020 was $112.5 million, or 12% of revenue, versus a loss of $30.1 million, or 6% of revenue, for the comparable period a year ago.

- Adjusted operating income4 for the fourth quarter of 2020 was $200.0 million, or 20% of revenue, compared with adjusted operating income of $28.5 million or 6% of revenue in the fourth quarter of 2019.

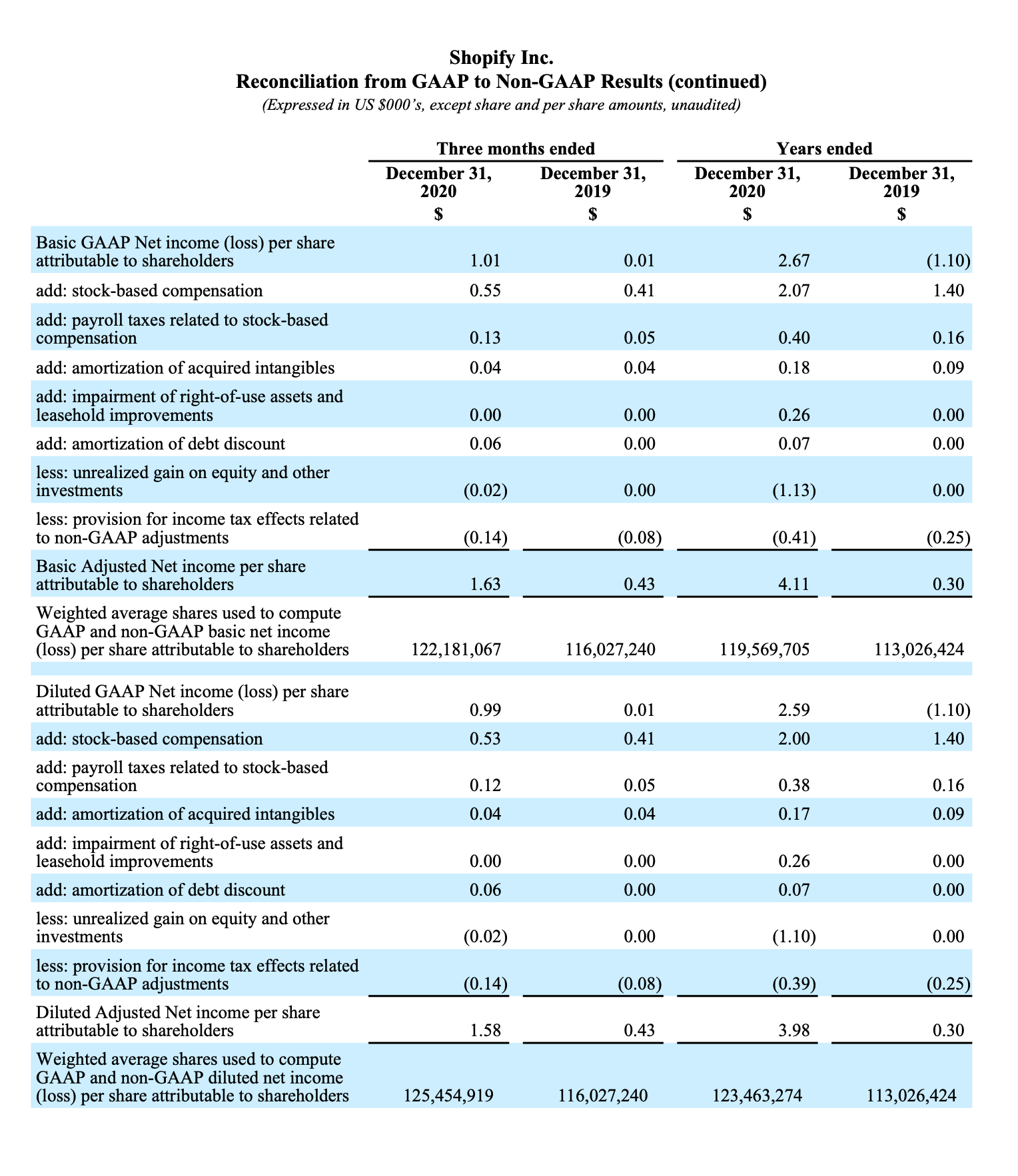

- Net income for the fourth quarter of 2020 was $123.9 million, or $0.99 per diluted share, compared with a net income of $0.8 million, or $0.01 per diluted share, for the fourth quarter of 2019.

- Adjusted net income4 for the fourth quarter of 2020 was $198.8 million, or $1.58 per diluted share, compared with adjusted net income of $50.0 million, or $0.43 per diluted share, for the fourth quarter of 2019.

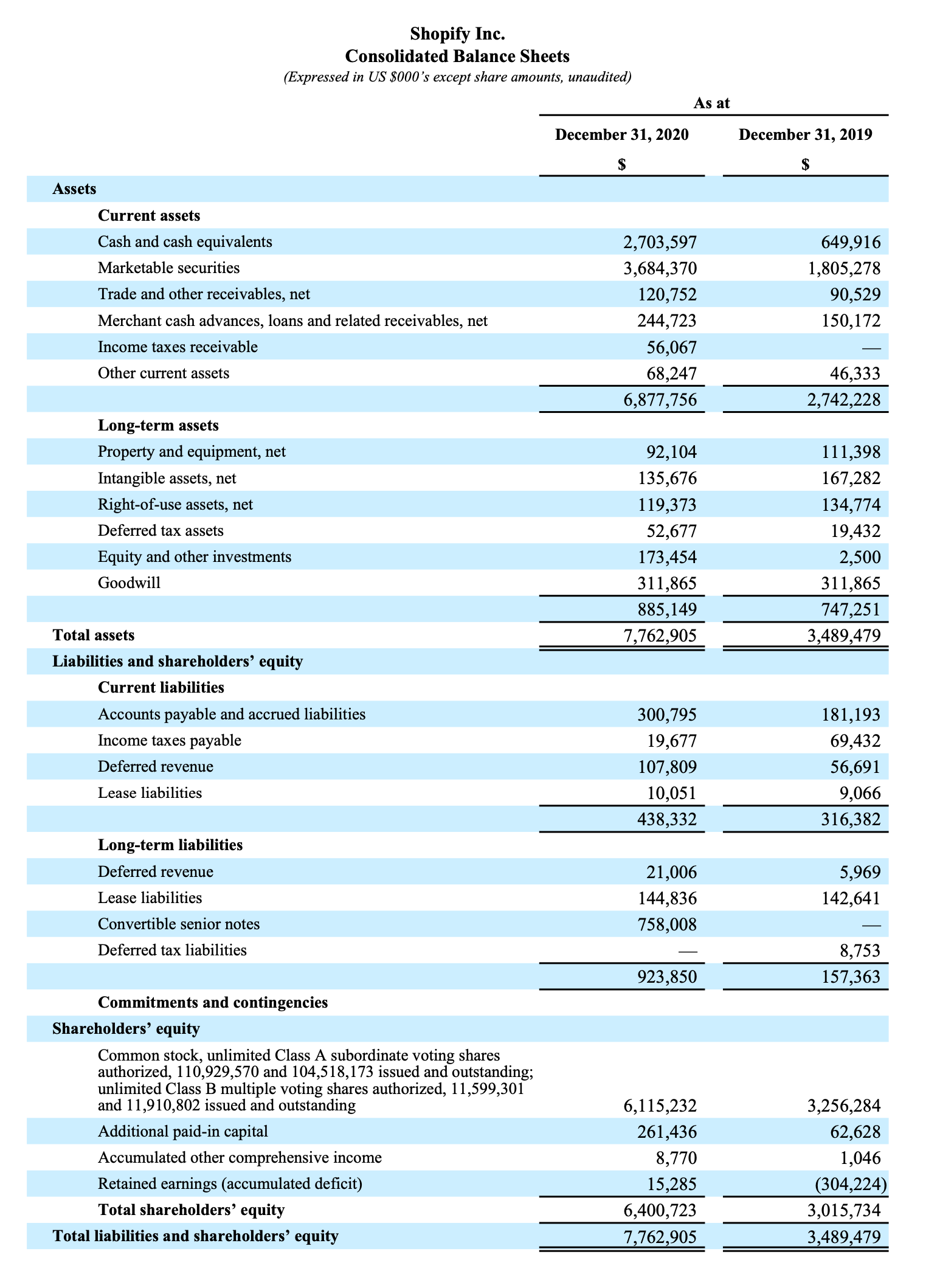

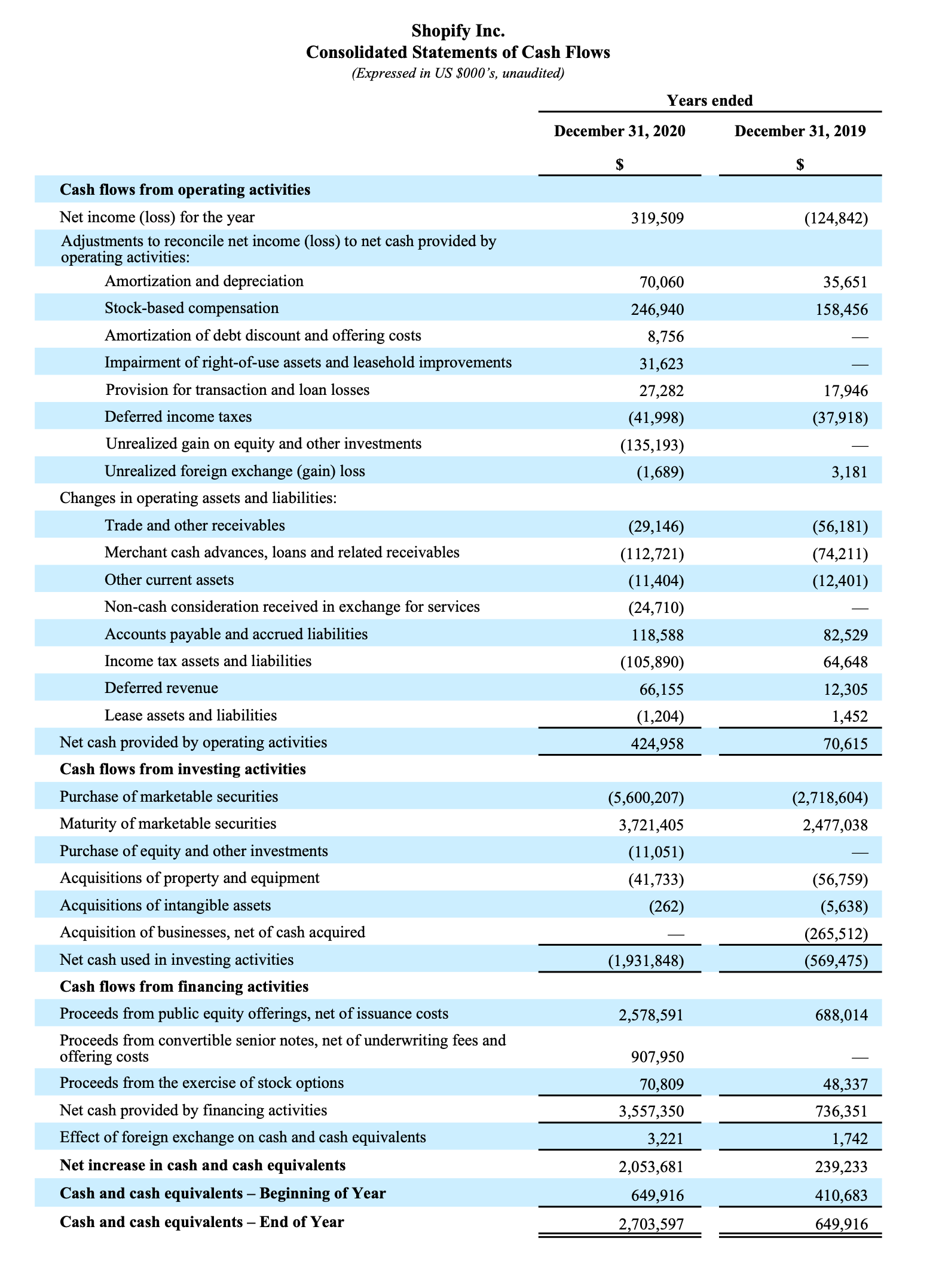

- At December 31, 2020, Shopify had $6.39 billion in cash, cash equivalents and marketable securities, compared with $2.46 billion on December 31, 2019. The increase reflects $2.03 billion of net proceeds from Shopify’s offering of Class A subordinate voting shares and convertible senior notes in the third quarter of 2020 and $1.46 billion of net proceeds from Shopify's offering of Class A subordinate voting shares in the second quarter of 2020.

Fourth-Quarter Business Highlights

- From the start of Black Friday in New Zealand, through the end of Cyber Monday in California, sales on Shopify’s platform reached more than $5.1 billion. This compares with more than $2.9 billion in GMV for the global Black Friday Cyber Monday period in 2019. Shopify also offset all carbon emissions from the delivery of every order placed on Shopify’s platform during the weekend, resulting in nearly 62,000 tonnes of carbon emissions offset.

- Shopify continued to build the foundation of Shopify Fulfillment Network, advancing the development of our software, support capabilities, and fulfillment operations. In the fourth quarter, we continued to harden our systems, executed multiple flash sales, processed record volume through the peak holiday season smoothly, and shipped our first self-service onboarding system, making it easier for merchants to start fulfilling their orders.

- 52% of eligible merchants in the United States and Canada utilized Shopify Shipping in the fourth quarter of 2020, versus 45% in the fourth quarter of 2019.

- Merchants in the U.S., Canada, and the U.K. received $226.9 million in merchant cash advances and loans from Shopify Capital in the fourth quarter of 2020, an increase of 96% versus the $115.9 million received by U.S. merchants in the fourth quarter of last year. Shopify Capital has grown to approximately $1.7 billion in cumulative capital advanced since its launch in April 2016, approximately $244.7 million of which was outstanding on December 31, 2020.

- Shopify’s partner ecosystem continued to expand, as approximately 42,200 partners referred a merchant to Shopify over the past 12 months, up 72% compared with 24,500 over the 12 months ended December 31, 2019.

Full-Year Financial Highlights

- Total revenue for the full year 2020 was $2,929.5 million, an 86% increase over 2019. Within this, Subscription Solutions revenue grew 41% to $908.8 million, while Merchant Solutions revenue grew 116% to $2,020.7 million.

- GMV1 for 2020 was $119.6 billion, an increase of 96% over 2019. GPV3 grew to $53.9 billion, which accounted for 45% of GMV processed versus $25.7 billion, or 42%, for 2019.

- Gross profit grew 78% to $1,541.5 million in 2020, compared with $865.6 million for 2019.

- Adjusted gross profit4 grew 78% to $1,568.5 million in 2020, compared with $879.4 million in 2019.

- Operating income for 2020 was $90.2 million, or 3% of revenue, versus an operating loss of $141.1 million, or 9% of revenue, for 2019.

- Adjusted operating income4 for 2020 was $437.4 million or 15% of revenue; adjusted operating income for 2019 was $45.8 million or 3% of revenue.

- Net income for 2020 was $319.5 million, or $2.59 per diluted share, compared with net loss of $124.8 million, or $1.10 per basic and diluted share, for 2019.

- Adjusted net income4 for 2020 was $491.3 million, or $3.98 per diluted share, compared with adjusted net income of $34.3 million, or $0.30 per diluted share, for 2019.

2020 Business Highlights

As a merchant-first company, everything that Shopify does is in service to our mission to make commerce better for everyone. In 2020, this translated to releasing features that focused on helping entrepreneurs to get online fast and start selling easily, to get discovered by buyers, and to get their products to buyers.

Get Online Fast and Start Selling Easily

- Shopify introduced a number of initiatives in the early days of the COVID-19 pandemic to help merchants quickly and easily start selling, including extending our 14-day free trial to 90-days for merchants trying out the platform between March 21 and May 31, making gift card capabilities available to merchants on all plans, and the introduction of buy-online-curbside pickup and local delivery.

- Shopify launched the all-new Shopify POS, a faster, more intuitive, and more scalable POS software designed to meet the needs of our most complex Brick-and-Mortar retailers, and introduced POS Pro, a new subscription offering with incremental valuable features such as buy-online-pickup-in store, staff roles and permissions, exchanges, and smart inventory management.

- Shopify launched Shopify Payments in Austria, as well as in Belgium, where we enabled iDEAL as a local payment method and support Bancontact debit payments, expanding the availability of Shopify Payments to 17 countries.

- Shopify expanded Shopify Capital beyond the U.S. to support merchants in the United Kingdom and Canada.

- Shopify launched Alipay as a payment method, allowing merchants in the U.S. to seamlessly accept payments through Alipay from more than one billion annual active users in China alone.

- Shopify began rolling out to a select number of merchants early access to Shop Pay Installments, a ‘buy now, pay later’ product that lets merchants offer their buyers more payment choice and flexibility at checkout, helping merchants boost sales through increased cart size and higher conversion.

Get Discovered by Buyers

- In April, Shopify launched Shop, an all-in-one mobile shopping assistant, which helps merchants deepen their relationships with existing buyers by putting a rediscovery tool at buyers’ fingertips. Shop also gives shoppers access to a range of features to create a more intuitive online shopping experience that merchants would otherwise have to assemble themselves. Shop includes our accelerated checkout, Shop Pay; our buy-now-pay-later product, Shop Pay Installments; order tracking; and carbon offsets of delivery emissions. Buyers can also discover local shops, Black-owned businesses, and other curated merchant lists within the app. At the end of 2020, Shop had more than 100 million registered users, including buyers that have opted in to Shop Pay as well as users of the app, and at the start of 2021 had more than 19 million Monthly Active Users. By the end of 2020, Shop Pay had facilitated nearly $20 billion in cumulative GMV since its launch in 2017.

- 2020 was a year of discovery of new merchants, as the number of consumers buying from Shopify merchants grew 52% from 2019 to nearly 457 million, an acceleration from the 38% year-over-year growth in consumers buying from Shopify merchants in 2019. Shopify helped merchants capitalize on this shift to online by expanding buyer discovery and selling opportunities, introducing several new sales and marketing channels, including Facebook Shops, Walmart, and Pinterest sales channels and the TikTok marketing channel.

Get Products to Buyers

- Shopify continued to build the product-market fit of Shopify Fulfillment Network by developing our fulfillment software, developing our network of warehouse and transportation partners, integrating 6 River Systems technology into our network, and enhancing our merchant-facing app to simplify fulfillment for our merchants.

- 6 River Systems released enhancements to its wall-to-wall fulfillment solution, including The Bridge, an overarching tool that connects the data from a physical warehouse operation to an intuitive cloud-based control center, providing more visibility into operations and increasing efficiency.

- Shopify introduced in-store/curbside pickup capabilities and local delivery options to brick-and-mortar merchants, enabling our merchants to participate in socially distanced selling and offering buyers a convenient, fast, and cost-effective way to shop while supporting local merchants.

- Shopify launched Shopify Shipping in Australia partnering with courier services company, Sendle. Australian merchants can save time and money by printing Sendle labels and booking free parcel pick up within the Shopify admin, with the benefits of affordable shipping rates, package tracking, and 100% carbon-neutral shipping.

Shopify is building a 100-year company with a rich ecosystem of merchants, partners, and our communities. In 2020, we supported several mission-aligned initiatives to help communities reach for economic independence and we invested in high-potential innovative solutions to remove carbon from the atmosphere and create a low carbon future. In 2020:

- Shopify announced a collaboration with Operation HOPE to help the organization’s goal to create one million new Black-owned businesses in the U.S. by 2030.

- Shopify announced three partnerships to help bring thousands of small businesses online and help them adapt to a digital economy. Partnerships include the Government of Canada through the ‘Go Digital Canada’ program, the New York State Government through ‘Empire State Digital’, and the Victoria State Government in Australia through the ‘Small Business Adaptation Program’.

-

Shopify directed the first $5 million of its Sustainability Fund, launched in 2019, toward the most promising technologies and projects for combating climate change. These initiatives include:

- Purchasing carbon removals and offsets from companies working on emerging technologies that permanently remove carbon from the atmosphere and solutions that temporarily sequester carbon or reduce carbon emissions.

- Offsetting all carbon emissions associated with the shipments of orders placed in the Shop app as well as all orders on the Shopify platform placed over the global Black Friday Cyber Monday holiday shopping weekend.

- Launch of the Offset app, allowing merchants to opt-in to offset the carbon emissions associated with shipments of all their deliveries.

Subsequent to 2020 year end, in February 2021, Shopify announced the expansion of our accelerated checkout, Shop Pay, to Facebook and Instagram. With this expansion, Shopify Payments will process all transactions by Shopify merchants on Facebook and Instagram upon full implementation of the integration later this year. This is the first time that Shop Pay is being offered outside of Shopify, giving buyers on Facebook and Instagram a fast and secure way to checkout and carbon emission offsets on every delivery. Shop Pay is now available as a payment option within Facebook to Shopify merchants using checkout on Instagram in the US, and will be rolling out to Shopify merchants using checkout on Facebook in the US in the coming weeks.

2021 Investments

In 2021, Shopify will help merchants take advantage of the strong secular shift to online commerce by investing in initiatives that put Shopify into the hands of more entrepreneurs, unlock the value of the platform for our merchants, and increasingly deliver scale benefits. We expect these investments to be largely reflected in the engineering talent we hire to execute on our initiatives and commercial efforts to raise awareness of Shopify and the power of our platform as we bring it to more entrepreneurs globally. Key areas of incremental investment planned for 2021 include the following:

- Shopify Fulfillment Network. To continue building the foundation of our fulfillment network, we intend to continue to invest in building the software that tightly integrates fulfillment into Shopify’s tech stack, optimizes our distributed network of nodes, and enhances the overall merchant experience to deliver fast and affordable fulfillment to our merchants’ buyers. We will also invest in 6 River Systems to continue innovating and enhancing its automated fulfillment technology to support the development Shopify Fulfillment Network as well as their network of external customers.

- Shop App. We will continue to develop the Shop App into a must-have shopping companion that fosters buyer loyalty and retention. We plan to invest in building features that will reduce friction for buyers at more points along their shopping journey, from discovery to delivery, creating value for both our merchants and their buyers.

- International. We plan to encourage more entrepreneurs to join Shopify and help merchants succeed by continuing to localize the platform in several non-English speaking geographies where we have a foothold. We intend to invest in enhancing and adding new features that make Shopify more intuitive and aligned with the commerce practices of merchants and buyers in these respective regions and in sales and marketing initiatives.

- Shopify POS. We plan to invest in growing adoption of our Retail POS and POS Pro offering by investing in foundational technologies to make it easier for merchants to onboard, and in our sales team, expanding our POS products to more countries and executing our go-to-market strategy.

- Shopify Plus. We plan to invest in bringing Shopify Plus's enterprise-level capabilities to more brands both in North America and internationally, offering larger, complex businesses a more agile and cost-effective way to manage their retail operations.

Shopify will continue to invest in our future across our platform and business. We are building a global commerce operating system that lowers the barrier to entry to entrepreneurship and provides our merchants with the tools they need to manage and scale their business across a number of channels. We will therefore continue to invest to enhance the speed, resilience and functionality of Shopify’s core platform, which supports merchants from startup to scale; and to further develop financial solutions available to merchants, including Shop Pay Installments and Shopify Balance.

Outlook

The outlook that follows constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control. Please see "Forward-looking Statements" below.

In addition to the other assumptions and factors described in this press release, Shopify’s outlook assumes the continuation of growth trends in our industry, our ability to manage our growth effectively, the absence of material changes in our industry or the global economy and other assumptions related to the COVID-19 pandemic, which are described in detail below. The following statements supersede all prior statements made by Shopify and are based on current expectations. As these statements are forward-looking, actual results may differ materially.

These statements do not give effect to the potential impact of mergers, acquisitions, divestitures or business combinations that may be announced or closed after the date hereof. All numbers provided in this section are approximate.

2020 was an exceptional year of growth in revenue and adjusted operating income for Shopify driven by the unprecedented acceleration of ecommerce by COVID, which drove an acceleration in the growth of GMV and new merchants on the platform, and which increased adoption of merchant solutions. We believe that changed behaviours adopted by merchants and consumers in 2020 have expanded the prospects for entrepreneurship and digital commerce significantly.

Our outlook coming into 2021 assumes that as countries roll out vaccines in 2021 and populations are able to move about more freely, the overall economic environment will likely improve, some consumer spending will likely rotate back to offline retail and services, and the ongoing shift to ecommerce, which accelerated in 2020, will likely resume a more normalized pace of growth. For the full year 2021, we expect:

- Subscriptions solutions revenue growth to be driven by more merchants around the world joining the platform in a number lower than the record in 2020, but higher than any year prior to 2020;

- The growth rates of subscription solutions and merchant solutions revenues to likely be more similar to each other than in the recent past, as we do not expect the surge in GMV that drove merchant solutions in 2020 to repeat;

- Merchant solutions revenue growth to be driven by continued GMV growth from existing merchants, new merchants joining the platform, and expanded adoption of Shopify’s growing menu of merchant solutions, including established offerings such as Shopify Payments, Shopify Shipping, and Shopify Capital, both geographically and as merchants grow into them, while newer solutions such as Shopify Fulfillment Network and 6 River Systems contribute nascent but incremental revenue in their early stages.

As a result, we expect that we will continue to grow revenue rapidly in 2021, albeit at a lower rate than in 2020. While we expect that the first quarter will likely still contribute the smallest share of full-year revenue and the fourth quarter the largest, the revenue spread may be more evenly distributed across the four quarters than it has been historically if the rollout of a vaccine shifts more spending to services and offline shopping towards the back half of the year.

2020 catapulted commerce into a period of incredibly rapid change, presenting Shopify with unprecedented opportunities in 2021 to accelerate innovation. We expect rapid growth in gross profit dollars in 2021, and plan to deploy substantially all of these dollars effectively, investing back into our business as aggressively as we can. In research and development, we are launching an ambitious hiring campaign for engineers that we expect will gain strength over the course of 2021. In sales and marketing, we expect to increase online marketing spend into increased global demand, expand sales and marketing efforts to capture more Plus and POS merchants both in North America and internationally, and enhance product marketing to help merchants take advantage of the full range of capabilities on the platform. For 2021, we anticipate stock-based compensation expenses and related payroll taxes of $465 million and amortization of acquired intangibles of $21 million.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our fourth-quarter results today, February 17, 2021, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/default.aspx#upcoming-events. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Audited Consolidated Financial Statements and accompanying Notes, Management's Discussion and Analysis and Annual Information Form for the year ended December 31, 2020 are available on Shopify’s website at www.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Shareholders may, upon request, receive a hard copy of the complete audited financial statements free of charge.

About Shopify

Shopify is a leading global commerce company, providing trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Shopify powers over 1.7 million businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Staples Canada, and many more. For more information, visit www.shopify.com.

We were proudly founded in Ottawa, Canada, but prefer to think of the company location as Internet, Everywhere. Shopify is a company of and by the internet, and we have physical outposts around the world. The archaic newswire system doesn’t allow us to acknowledge this fact, so we will henceforth keep this paragraph in our press releases until technology improves.

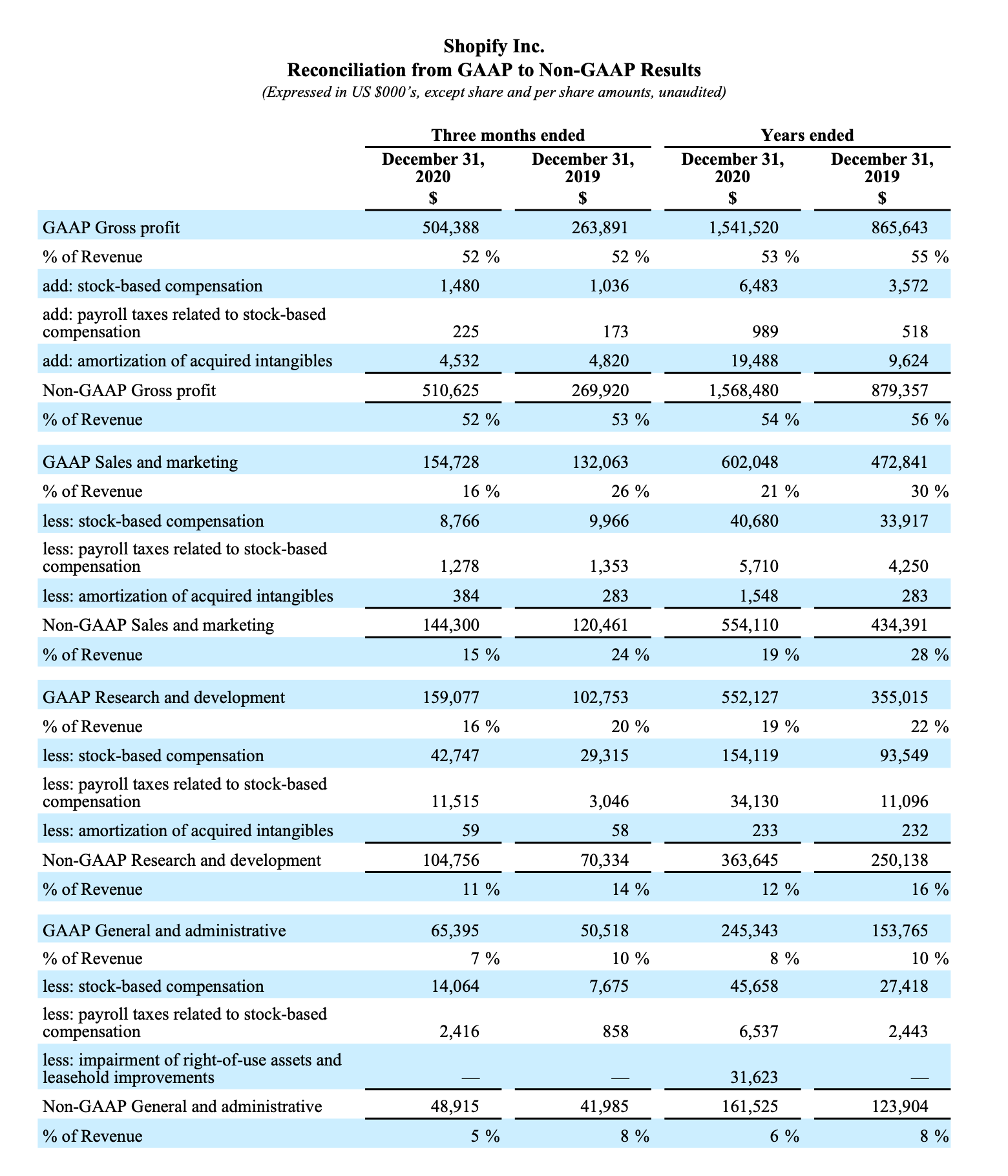

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted operating income, non-GAAP operating expenses, adjusted net income and adjusted net income per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, and an impairment of right-of-use assets and leasehold improvements. Adjusted net income and adjusted net income per share also exclude amortization of the debt discount related to Shopify’s convertible senior notes, unrealized gains on equity and other investments, and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including statements regarding Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as “believe”, "continue", "will", "intends", "support", “plan”, “anticipate”, “allow”, and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: (i) merchant acquisition and retention; (ii) managing our growth; (iii) our potential inability to compete successfully against current and future competitors; (iv) the security of personal information we store relating to merchants and their customers and consumers with whom we have a direct relationship; (v) our history of losses and our ability to maintain profitability; (vi) a disruption of service or security breach; (vii) our limited operating history in new markets and geographic regions; (viii) our ability to innovate; (ix) international sales and operations and the use of our platform in various countries; (x) our reliance on a single supplier to provide the technology we offer through Shopify Payments; (xi) our potential inability to hire, retain and motivate qualified personnel; (xii) our use of a single cloud-based platform to deliver our services; (xiii) uncertainty around the duration and scope of the COVID-19 pandemic and the impact of the pandemic and actions taken in response on global and regional economies and economic activity; (xiv) the reliance of our growth in part on the success of our strategic relationships with third parties; (xv) complex and changing laws and regulations worldwide; (xvi) our dependence on the continued services of management and other key employees; (xvii) our potential failure to effectively maintain, promote and enhance our brand; (xviii) payments processed through Shopify Payments; (xix) serious errors or defects in our software or hardware or issues with our hardware supply chain; (xx) our potential inability to achieve or maintain data transmission capacity; (xxi) activities of merchants or partners or the contents of merchants’ shops; (xxii) evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations may limit the use and adoption of our services; (xxiii) changes in tax laws or adverse outcomes related to our taxes; (xiv) other one-time events and other important factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

1. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

2. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month.

3. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments.

4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, impairment of right-of-use assets and leasehold improvements, amortization of the debt discount related to convertible senior notes, unrealized gains on equity and other investments, and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information.

Shopify Announces Fourth-Quarter and Full-Year 2020 Financial Results.pdf