Fourth-Quarter Revenue Grows 26%, 28% on a Constant Currency Basis

GMV Exceeds $60 billion for the fourth quarter and $197 billion for 2022

Internet, Everywhere - February 15, 2023 - Shopify Inc. (NYSE, TSX: SHOP), a provider of essential internet infrastructure for commerce, announced today financial results for the quarter and year ended December 31, 2022.

“Since the very beginning, Shopify’s mission has been to level the playing field for our merchants by lowering barriers, simplifying operations, and leveraging our scale to give them the superpowers they need to compete globally. The strength of our Q4 and full year performance in 2022 is a testament to the resilience of our merchants. Despite persistent macroeconomic challenges, they continued to succeed on Shopify, growing sales and using more of our mission-critical tools to run their businesses,” said Harley Finkelstein, Shopify President. “Our platform and solutions enable our merchants to stay ahead of the dynamically changing commerce landscape. We know the commerce evolution is not relegated to just ecommerce or retail, it’s about commerce being everywhere, for everyone. Shopify launched several new key strategic products in 2022, and we are excited about the potential for them to help our merchants succeed. In 2023, we will continue to bring innovative modern commerce solutions to the millions of Shopify merchants and their buyers.”

2022 Business Highlights

In 2022, Shopify remained focused on simplifying commerce operations so merchants can focus on what matters most to them - their products and their customers. We continue to build mission critical solutions to power the future of commerce, bringing more merchants of all sizes on to our commerce platform including consumers' favorite brands like Mattel, Supreme, Black and Decker, Glossier, and ButcherBox as well as notable celebrity brands such as SKKN by Kim Kardashian, Feastables by Mr. Beast, and Joopiter by Pharrell Williams.

Below are some highlights from the year across key themes that drive our solutions for merchants – attracting and retaining customers through more and more channels, going global, and going from first sale to full scale.

Enabling First Sale To Full Scale

- Rolled out Shop Promise, a consumer-facing badge that provides accurate anticipated delivery dates across a merchant’s online store, checkout, and on the Shop app. With the release of our Editions last week, we have started to expand Shop Promise beyond just Shopify Fulfillment Network (“SFN”) merchants to all eligible U.S. merchants. For merchants using SFN, Shop Promise is now automatically enabled and will appear on merchant storefronts, guaranteeing faster, more reliable delivery and up to 25% higher conversion rates.

- Released Hydrogen and Oxygen helping merchants fast-track their custom storefront build with the tooling they need to accelerate development using Hydrogen, our React-based headless commerce stack. And with just one click, merchants can deploy their Hydrogen storefronts on Oxygen, our global hosting solution at no additional cost. Within Editions, on February 9th we released Hydrogen 2 - now built on Remix and made Oxygen available to more Shopify plans.

- Launched Shopify Tax, which offers robust tax compliance tools for U.S.-based merchants that sell to customers in the United States, including sales tax liability insights, product category suggestions, and precise calculation technology to collect tax based on specific addresses within 11,000+ United States tax jurisdictions.

- Launched Shopify Functions, which enables larger and enterprise brands to customize out-of-the-box Shopify features to meet their unique needs without ever touching software code.

Reducing Barriers As Shopify Helps Merchants Go Global

- Completed the roll out Shopify Markets to all merchants and launched early access in the U.S. of Shopify Markets Pro, a native end-to-end cross border solution with a merchant of record offering that enables merchants to enter 150+ markets overnight.

- Launched Shopify Payments in France, Finland, Czech Republic, Switzerland and Portugal, expanding the availability of Shopify Payments to 22 countries.

- Launched Shopify POS in Belgium, Denmark, Finland, Italy, Spain, and Singapore, bringing the total number of countries where we offer our POS hardware integrated with Shopify payments to 14 countries.

- Launched Shopify Capital in Australia, expanding the availability of Shopify Capital to four countries.

- Introduced Shopify Shipping to merchants in France, Italy, and Spain, expanding the availability of Shopify Shipping to seven countries.

Helping Our Merchants Attract More Buyers Through More Channels

- Introduced POS Go, a powerful hardware that is an all-in-one mobile POS device. Merchants can scan barcodes, accept tap, chip, and swipe payments, and use Shopify POS all from one handheld device. In addition, Shopify launched Tap to Pay on iPhone, which allows merchants to accept contactless credit and debit cards and digital wallets without any hardware.

- Launched Shopify Audiences, a marketing tool powered by an audience network and machine learning that helps merchants find high-intent buyers for their products. As of the end of 2022, merchants can sync Shopify Audiences with Facebook and Instagram. Shopify also launched Audiences for Google in Q4, allowing merchants to reach high-intent audiences from their own store - across YouTube, Google Search, Google Display Network, and Gmail. Within Editions on February 9th we announced the launch of Audiences for Pinterest, which operates like the Meta integration where Plus merchants can use the tool to find high-intent buyers across Shopify and upload to Pinterest for better targeting.

- Introduced Shopify Collabs, a sales channel for merchants to find and collaborate with creators to promote products to new audiences. For creators, the app provides accessibility to promote new products and grow their business.

- Within social commerce, Shopify continued to integrate with more channels, launching on the Twitter Shopping Channel and YouTube shopping channel integrated with Shop Pay. Shopify also launched LinkPop, a customizable link-in-bio tool that lets Shopify merchants sell products with shoppable links and gives users powerful analytics tools to see which contents and products captivate their followers.

Other Full Year Business Highlights

- Introduced Shopify Editions, a bi-annual product showcase that features new launches and improvements across the entire platform. In the first ever release, Shopify debuted over 100 new product features.

- Signed partnership agreements with key system integrators, including Accenture, Deloitte, Ernst & Young, KPMG, and in January 2023, with IBM Consulting, to enable greater opportunities for adoption of Shopify with larger brands.

- Implemented Flex Comp, a new market-competitive compensation system designed to recruit, reward and retain the best talent in the world that gives employees greater agency and clarity on how they are compensated across base pay and equity.

- Released Planet, an app that Shopify merchants can use to zero out their shipping emissions. Planet calculates the estimated shipping emissions from every order. Merchants then remove these emissions by funding the same carbon removal companies supported by Shopify. Since launch, more than 8,000 Shopify merchants have used Planet to neutralize their shipping emissions on more than 6,000,000 orders, totaling over 5,000 tonnes of carbon removal.

Subsequent To Fourth-Quarter 2022

- Shopify updated its pricing for Basic, Shopify, and Advanced plans. The updated pricing went into effect for new merchants on January 24, 2023.

- Shopify announced the opening of our infrastructure to power the biggest retailers in the world with Commerce Components by Shopify (“CCS”), the modern, composable stack for enterprise retail. CCS combines access to Shopify’s foundational, high-performing components along with flexible APIs to build dynamic customer experiences that integrate seamlessly with a retailer’s preferred back office services.

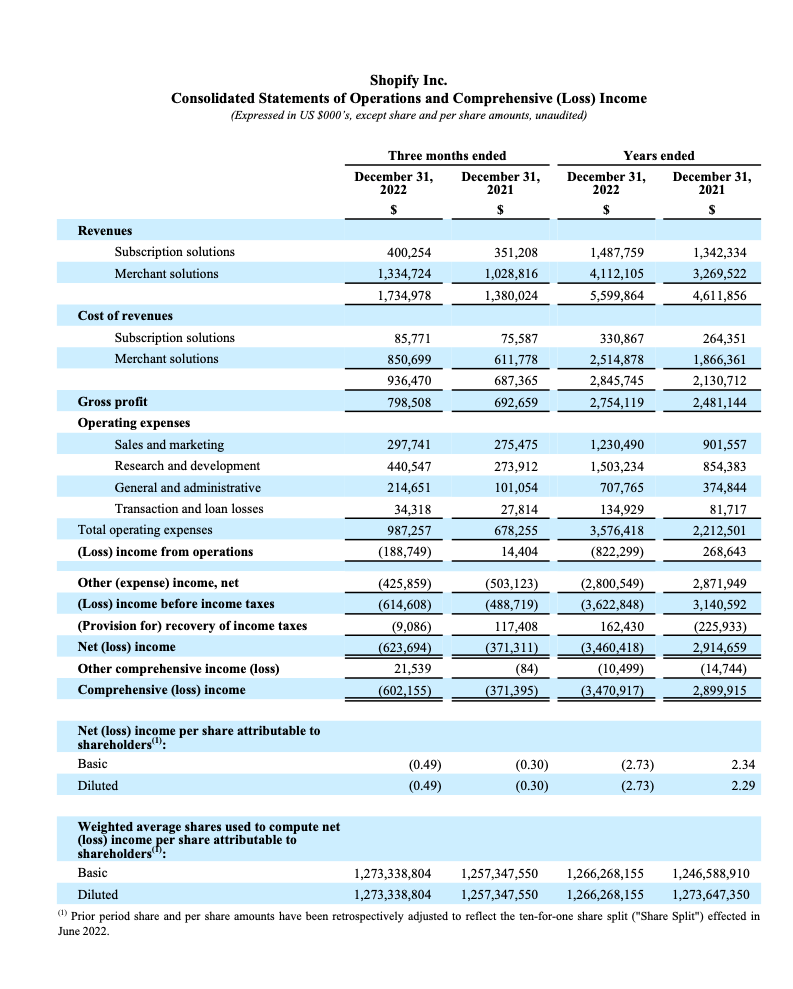

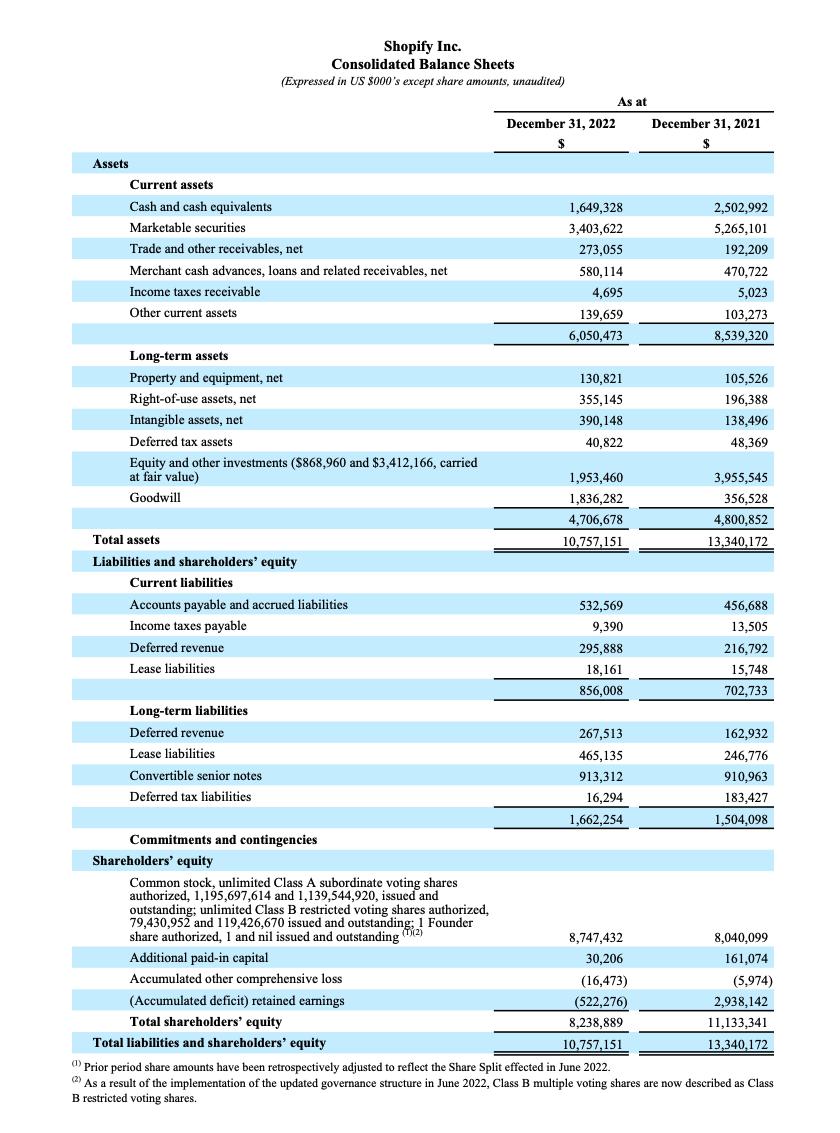

Fourth-Quarter Financial Highlights

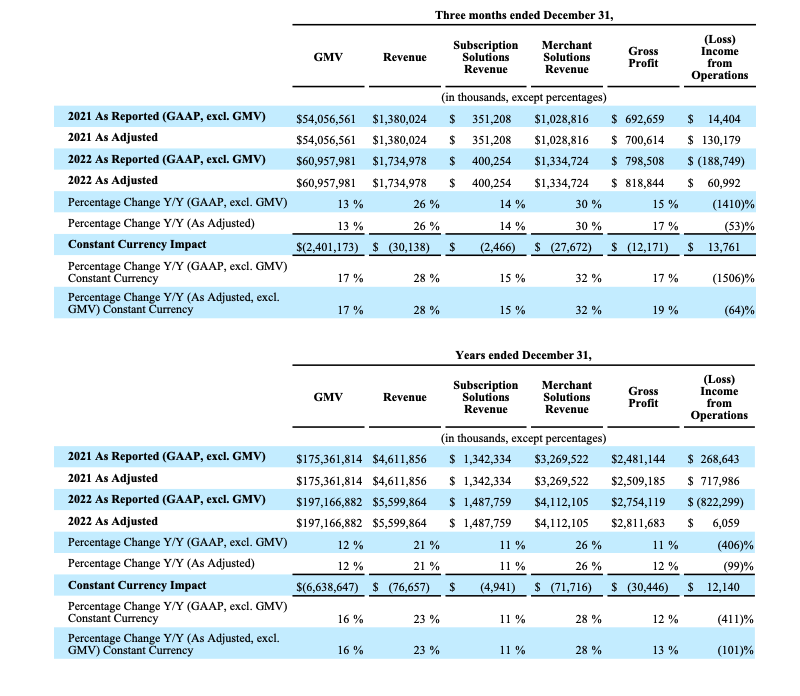

- Gross Merchandise Volume1("GMV") increased 13% to $61.0 billion, an increase of $6.9 billion over the fourth quarter of 2021, up 17% on a constant currency basis. Gross Payments Volume2 ("GPV") grew to $34.2 billion, representing 56% of GMV processed in the quarter, versus $27.7 billion, or 51%, for the fourth quarter of 2021.

- Total revenue increased 26% to $1.7 billion compared to the prior year, up 28% on a constant currency basis.

- Merchant Solutions revenue increased 30% to $1.3 billion compared to the prior year, up 32% on a constant currency basis, driven primarily by the growth of GMV, our increased attach rate – most notably from Shopify Payments and the addition of Deliverr – and lastly greater revenue contribution from partners.

- Subscription Solutions revenue increased 14% to $400.3 million compared to the prior year, primarily due to more merchants joining the platform as well as higher variable platform fees and apps.

- Monthly Recurring Revenue3("MRR") as of December 31, 2022 increased 7% to $109.5 million compared to the prior year. The gains year over year in the number of Shopify Plus merchants on the platform and the thousands of additional retail locations utilizing POS Pro were partially offset by the impact of the free and paid trial experiences that ran throughout the quarter. These trial programs are immaterial to MRR until those merchants convert to one of our non-Plus subscriptions. Shopify Plus contributed $36.6 million, or 33%, of MRR compared with 29% of MRR as of December 31, 2021.

- Gross profit dollars grew 15% to $798.5 million, compared to the prior year. Gross margin for the quarter was 46.0% compared to 50.2% in Q4 2021, driven primarily by contributions from lower margin Shopify Payments and Deliverr revenue.

- Operating loss was $188.7 million, or 11% of revenue, versus income of $14.4 million, or 1.0% of revenue, for the comparable period a year ago.

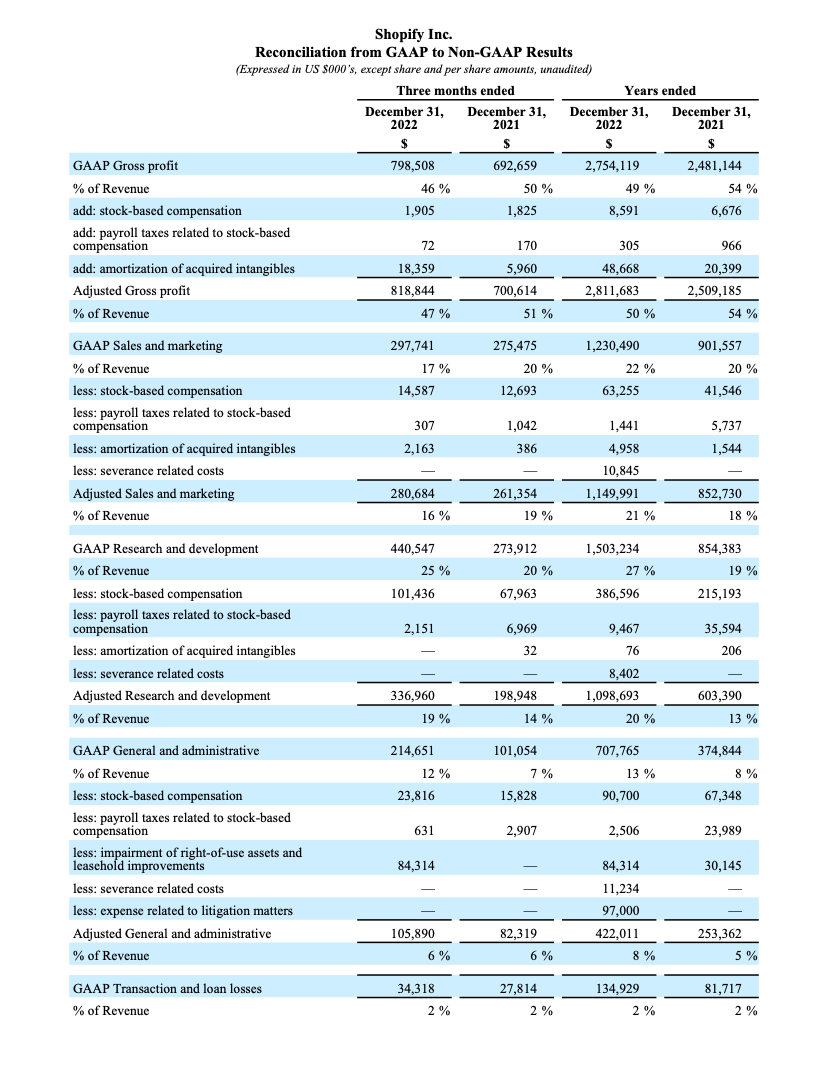

- Adjusted operating income4 was $61.0 million, or 4% of revenue, compared with adjusted operating income of $130.2 million or 9% of revenue in the fourth quarter of 2021. The difference primarily reflects increases in compensation driven by the implementation of our new compensation system and increased headcount including Deliverr. Fourth quarter 2022 adjusted operating income excludes a real estate-related impairment charge.

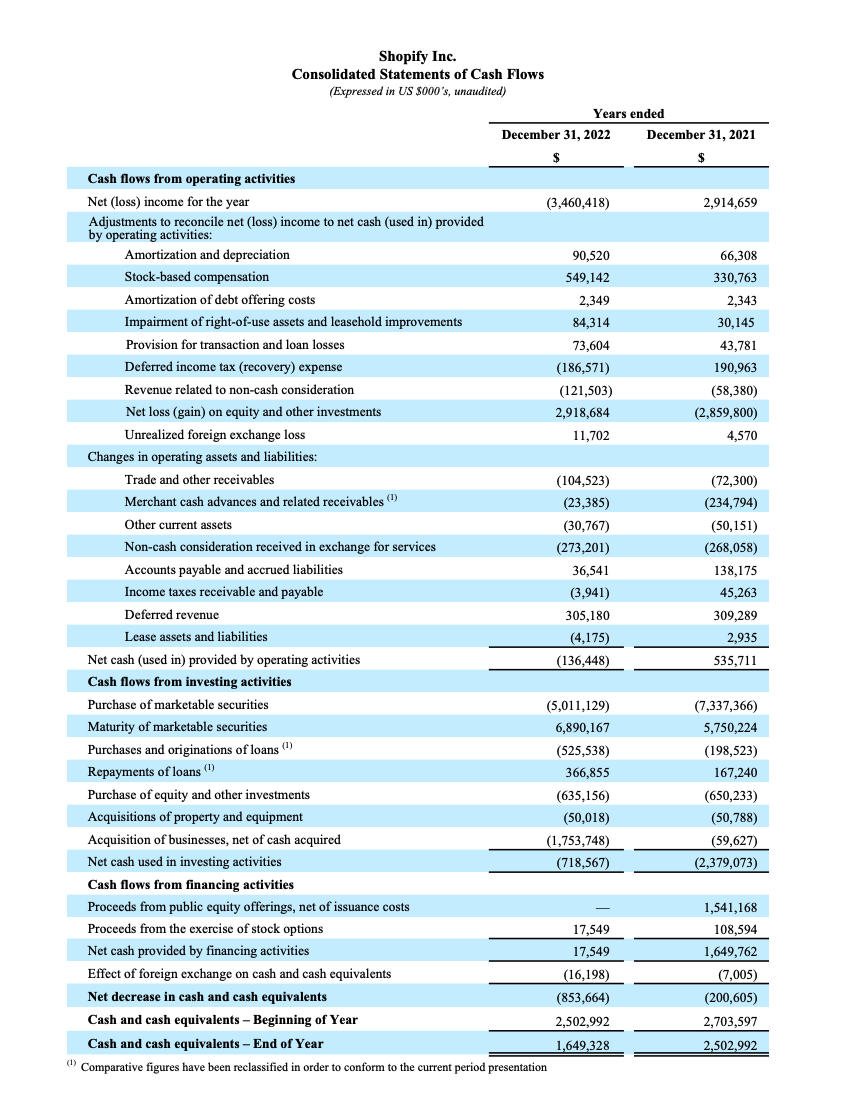

- Merchants in the U.S., Canada, Australia and the U.K. received $393.2 million in merchant cash advances and loans from Shopify Capital in the fourth quarter of 2022, an increase of 21% versus the $323.7 million funded in the fourth quarter of last year. Shopify Capital has grown to $4.7 billion in cumulative capital funded since its launch in April 2016, approximately $580.1 million of which was outstanding on December 31, 2022.

Full Year Financial Highlights

- GMV1 increased 12% to $197.2 billion, compared to 2021, up 16% on a constant currency basis. GPV2 grew to $106.1 billion, which accounted for 54% of GMV processed versus $85.8 billion or 49%, for 2021.

- Total revenue increased 21% to $5.6 billion, compared to 2021, up 23% on a constant currency basis. Within this, Subscription Solutions revenue grew 11% to $1.5 billion. Merchant Solutions revenue grew 26% to $4.1 billion, up 28% on a constant currency basis.

- Gross profit dollars grew 11% to $2.8 billion in 2022, compared with $2.5 billion for 2021. Gross margin was 49.2% compared to 53.8% in 2021, reflecting a greater mix of lower margin Shopify Payments and Deliverr revenue.

- Operating loss for 2022 was $822.3 million, or 15% of revenue, versus income of $268.6 million, or 6% of revenue, for 2021.

- Adjusted operating income4 for 2022 was $6.1 million, or 0.1% of revenue, compared to adjusted operating income of $718.0 million, or 16% of revenue in 2021. The difference primarily reflects increases in compensation driven by the implementation of our new compensation system and increased headcount including Deliverr. Additionally, 2022 adjusted operating income excludes one-time charges from severance-related costs connected to the workforce reduction announced in July, two accruals for litigation contingencies, and a real estate-related impairment charge.

2023 Outlook

The outlook that follows supersedes all prior financial outlook statements made by Shopify, constitutes forward-looking information within the meaning of applicable securities laws, and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control. Please see "Forward-looking Statements" below for more information.

Our 2023 financial outlook includes the pricing changes to our subscription plans; the expected impact of Shopify Fulfillment Network and Deliverr; and increased personnel-related expenses, including the impact from Flex Comp. Additionally, while our financial outlook assumes that the COVID-triggered acceleration of ecommerce continues to return to a more normalized rate of growth in 2023, there is elevated inflation and continued caution around consumer spending due to a variety of macroeconomic factors.

For the first quarter of 2023 we expect:

- Revenue growth in the high-teen percentages on a year over year basis;

- Gross margin to be slightly higher than our fourth quarter of 2022 gross margin;

- Operating expense growth in the low-single digit percentages versus our fourth quarter of 2022 operating expenses when excluding one-time charges in the fourth quarter of 2022;

- Stock-based compensation to be in-line with what we saw in the fourth quarter of 2022; and

- Capital expenditures to be in-line with capital spend in full year of 2022.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our fourth-quarter and year end results today, February 15, 2023, at 5:00 p.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Audited Consolidated Financial Statements and accompanying Notes, Management's Discussion and Analysis and Annual Information Form for the year ended December 31, 2022 will be available on Shopify’s website at www.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Shareholders may, upon request, receive a hard copy of the complete audited financial statements free of charge.

About Shopify

Shopify is the leading global commerce company that provides essential internet infrastructure for commerce, offering trusted tools to start, scale, market, and run a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for speed, customization, reliability, and security, while delivering a better shopping experience for consumers online, in store and everywhere in between. Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Mattel, Gymshark, Heinz, FTD, Netflix, Kylie Cosmetics, SKIMS, Supreme, and many more. For more information, visit www.shopify.com.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as "continue", “may”, "will", “could”, “plan”, “anticipate”, "become", "enable", “believe” and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: sustaining our rapid growth; managing our growth; our potential inability to compete successfully against current and future competitors; the security of personal information we store relating to merchants and their buyers, as well as consumers with whom we have a direct relationship including users of our apps; a denial of service attack or security breach; our ability to innovate; our limited operating history in new and developing markets and geographic regions; international sales and operations and the use of our platform in various countries; our current reliance on a single supplier to provide the technology we offer through Shopify Payments; the reliance of our growth in part on the success of our strategic relationships with third parties; our potential inability to hire, retain and motivate qualified personnel; our use of third-party cloud providers to deliver our platform services; complex and changing laws and regulations worldwide; our dependence on the continued services of our senior management and other key employees; the COVID-19 pandemic and its impact on our business, financial condition and results of operations including the impact of measures taken to contain the virus and the impact on the global economy and consumer spending on our merchants' and partners' ecosystem; payments processed through Shopify Payments, Shop Pay Installments, or payments processed or funds managed through Shopify Balance; our history of losses and our ability to maintain profitability; our potential failure to effectively maintain, promote and enhance our brand; serious errors or defects in our software or hardware; our potential inability to achieve or maintain data transmission capacity; activities of merchants or partners or the content of merchants' shops and our ability to detect and address unauthorized activity on our platform; evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations that may limit the use and adoption of our services; the impact of acquisitions, divestitures, investments, or other significant transactions; our ability to successfully scale, optimize and operate Shopify Fulfillment Network; risks associated with Shopify Capital, and offering financing to merchants; potential claims by third parties of intellectual property infringement or other third arty or governmental claims, litigation, disputes, or other proceedings; our reliance on computer hardware, purchased or leased, software licensed from and services rendered by third parties, in order to provide our solutions and run our business, sometimes by a single-source supplier; the impact of worldwide economic conditions, such as economic impacts due to the Russian invasion of Ukraine, including the resulting effect on spending by small and medium-sized businesses or their buyers; manufacturing and supply chain risks; unanticipated changes in tax laws or adverse outcomes resulting from examination of our income or other tax returns; being required to collect federal, state, provincial or local business taxes, sales and use taxes or other indirect taxes in additional jurisdictions on transactions by our merchants; the interoperability of our platform with mobile devices and operating systems; changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers; our potential inability to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third parties from making unauthorized use of our technology; our pricing decisions for our solutions, including localized pricing for different markets; our use of open source software; seasonal fluctuations; exchange rate fluctuations that may negatively affect our results of operations; our dependence upon buyers’ and merchants’ access to, and willingness to use, the internet for commerce; provisions of our financial instruments including our notes; our potential inability to raise additional funds as may be needed to pursue our growth strategy or continue our operations, on favorable terms or at all; our tax loss carryforwards; the ownership of our shares; our sensitivity to interest rate fluctuations; our concentration of credit risk, and the ability to mitigate that risk using third parties, periodic variability in how compensation expense is allocated between cash and stock-based compensation due to compensation allocations by our employees under our new compensation system, Flex Comp; industry or macroeconomic trends or developments, including inflation; and other events and factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

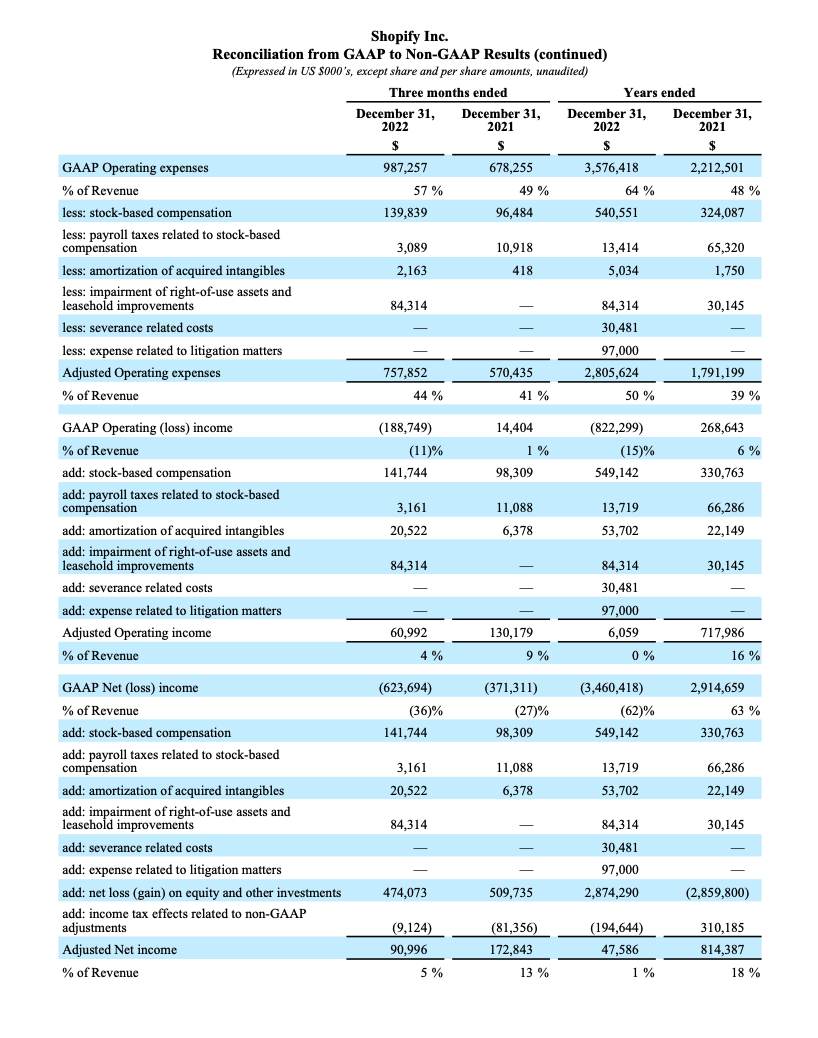

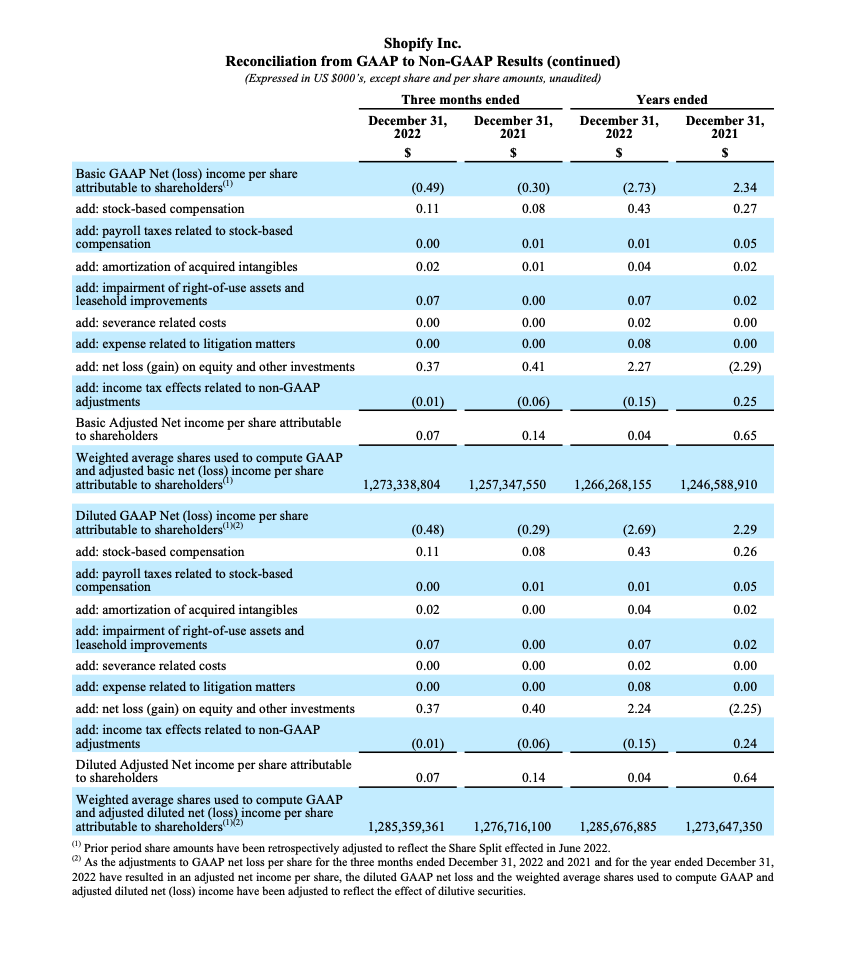

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted sales and marketing, adjusted research and development, adjusted general and administrative expenses, adjusted operating income/loss, adjusted net income/loss and adjusted net income/loss per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, employee severance relating to the July 2022 reduction in workforce, the provision associated with two litigation-related accruals in the third quarter of 2022, and real estate- related impairment charges. Adjusted net income/loss and adjusted net income/loss per share also exclude unrealized and realized gains and losses on equity and other investments and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Financial Performance Constant Currency Analysis

The following key performance indicator and non-GAAP financial measure converts our GMV, revenues, gross profit and (loss) income from operations using the comparative period's monthly average exchange rates. This effect of foreign exchange rates on our key performance indicator and consolidated statements of operations disclosure is a supplement to our consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP. We have provided the below key performance indicator and non-GAAP disclosure as we believe it presents a clear comparison of our period to period operating results by removing the impact of fluctuations in foreign exchange rates and to assist investors in understanding our financial and operating performance. The key performance indicator and non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP, do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such key performance indicators and non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with U.S. GAAP.

____________________________________________________________________________________________

1. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

2. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments.

3. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month.

4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, employee severance, expense related to litigation matters, unrealized and realized gains and losses on equity and other investments, a real estate-related impairments charge and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information.

Shopify Announces Fourth-Quarter and Full-Year 2022 Financial Results.pdf