Achieves First $1 Billion Revenue Quarter on Record GMV

Helping Independent Brands Compete as Commerce Goes Digital

Shopify reports in U.S. dollars and in accordance with U.S. GAAP

Internet, Everywhere - July 28, 2021 - Shopify Inc. (NYSE:SHOP)(TSX:SHOP), a provider of essential internet infrastructure for commerce, announced today strong financial results for the quarter ended June 30, 2021.

“This past year has been one of great uncertainty for independent merchants. What used to be two completely distinct industries, the retail industry and the online commerce industry, are now just the commerce industry. In this new reality, our goal at Shopify is clearer than ever: we want to give entrepreneurs around the world the best chance to create their own certainty, to reach for independence and to seize opportunity that they uniquely see. Shopify is building the essential infrastructure for this increasingly digital world to allow as many people as possible to participate,” said Tobi Lütke, Shopify's CEO at our recent Shopify Unite developer conference.

“Shopify fired on all cylinders in our second quarter, keeping our merchants well equipped to seize the opportunities presented in a post-pandemic retail era,” said Amy Shapero, Shopify’s CFO. “As consumer spending remained strong, our merchants thrived and extracted more value from our platform, contributing to our rapid growth. We built on our momentum, making significant updates to our platform infrastructure, expanding strategic partnerships, and advancing our portfolio of growth initiatives to future-proof the success of tomorrow’s entrepreneurs.”

Second-Quarter Financial Highlights

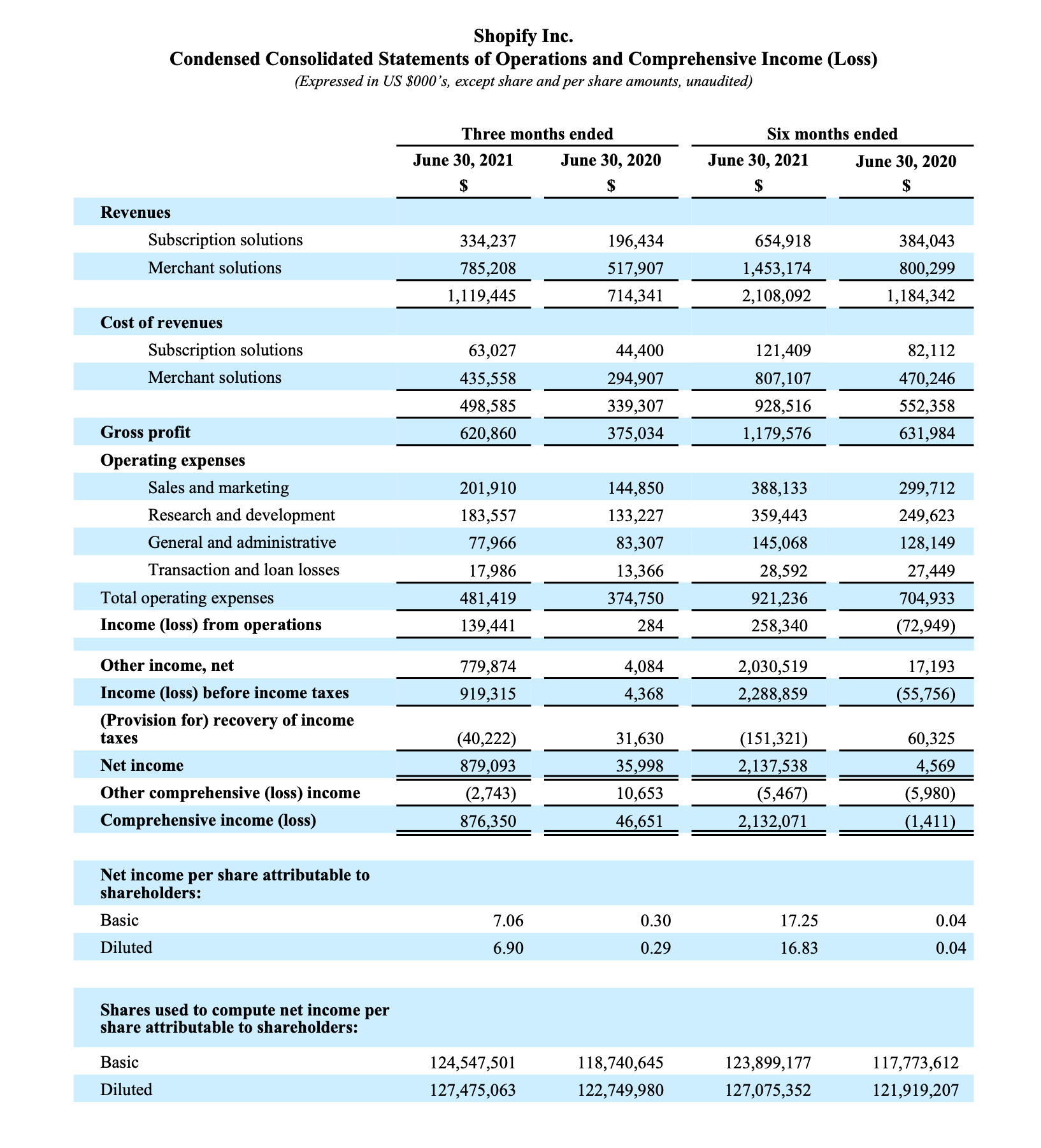

- Total revenue in the second quarter was $1,119.4 million, up 57% year over year.

- Subscription Solutions revenue was $334.2 million, up 70% year over year, primarily due to more merchants joining the platform.

- Merchant Solutions revenue was $785.2 million, up 52%, driven primarily by the growth of Gross Merchandise Volume1 ("GMV").

- Monthly Recurring Revenue2 ("MRR") as of June 30, 2021 was $95.1 million. Growth accelerated to 67% year-over-year with MRR up from $57.0 million as of June 30, 2020 as more merchants joined the platform and the number of retail locations using POS Pro increased. Shopify Plus contributed $25.2 million, or 26%, of MRR compared with 29% of MRR as of June 30, 2020 as a result of the significantly higher number of merchants on standard plans joining the platform in the past 12 months and new incremental revenue from our Retail POS Pro subscription offering.

- GMV for the second quarter was $42.2 billion, an increase of $12.1 billion or 40% over the second quarter of 2020. Gross Payments Volume3 ("GPV") grew to $20.3 billion, which accounted for 48.0% of GMV processed in the quarter, versus $13.4 billion, or 45%, for the second quarter of 2020.

- Gross profit dollars grew 66% to $620.9 million in the second quarter of 2021, compared with $375.0 million for the second quarter of 2020.

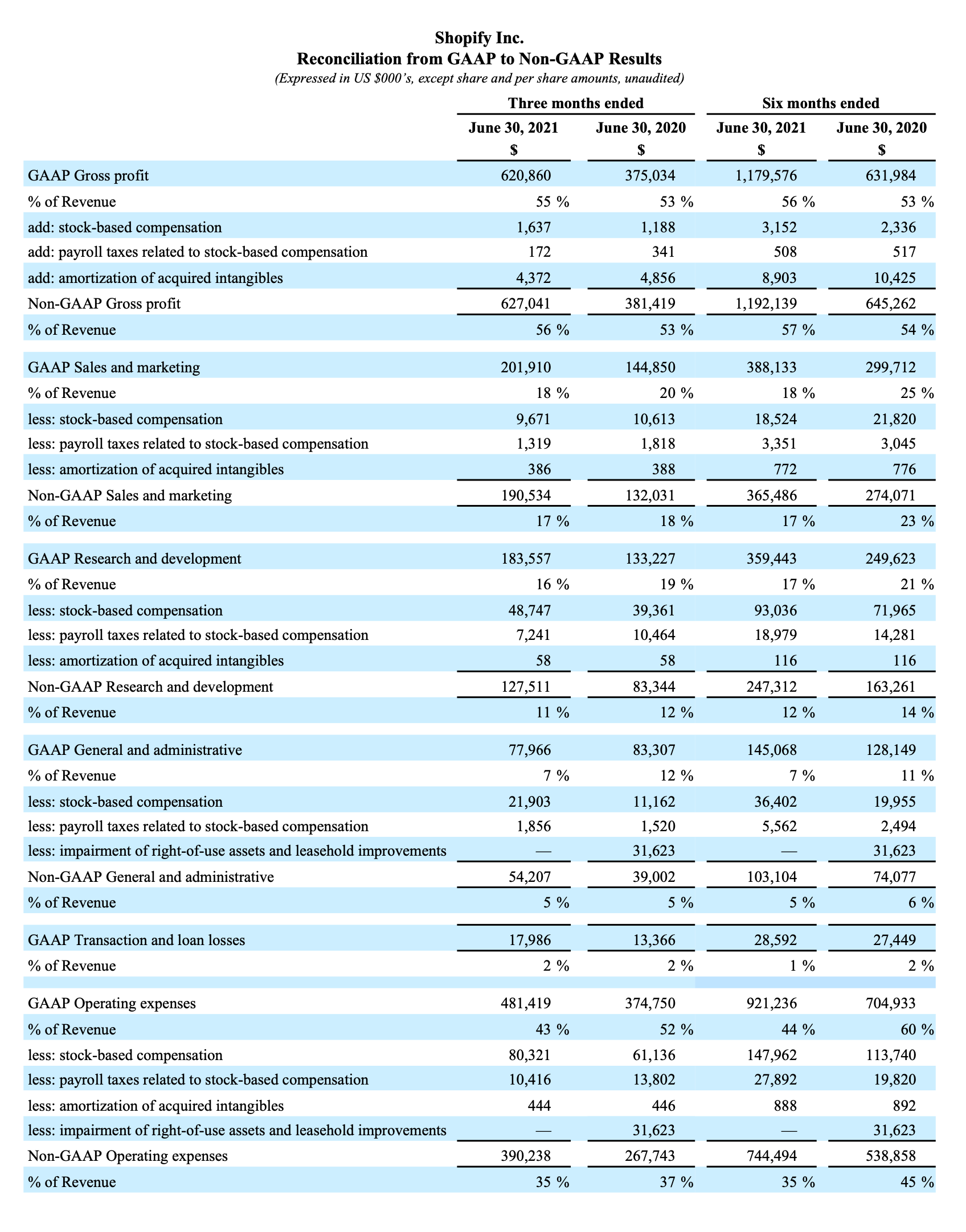

- Adjusted gross profit4 dollars grew 64% to $627.0 million in the second quarter of 2021, compared with $381.4 million for the second quarter of 2020.

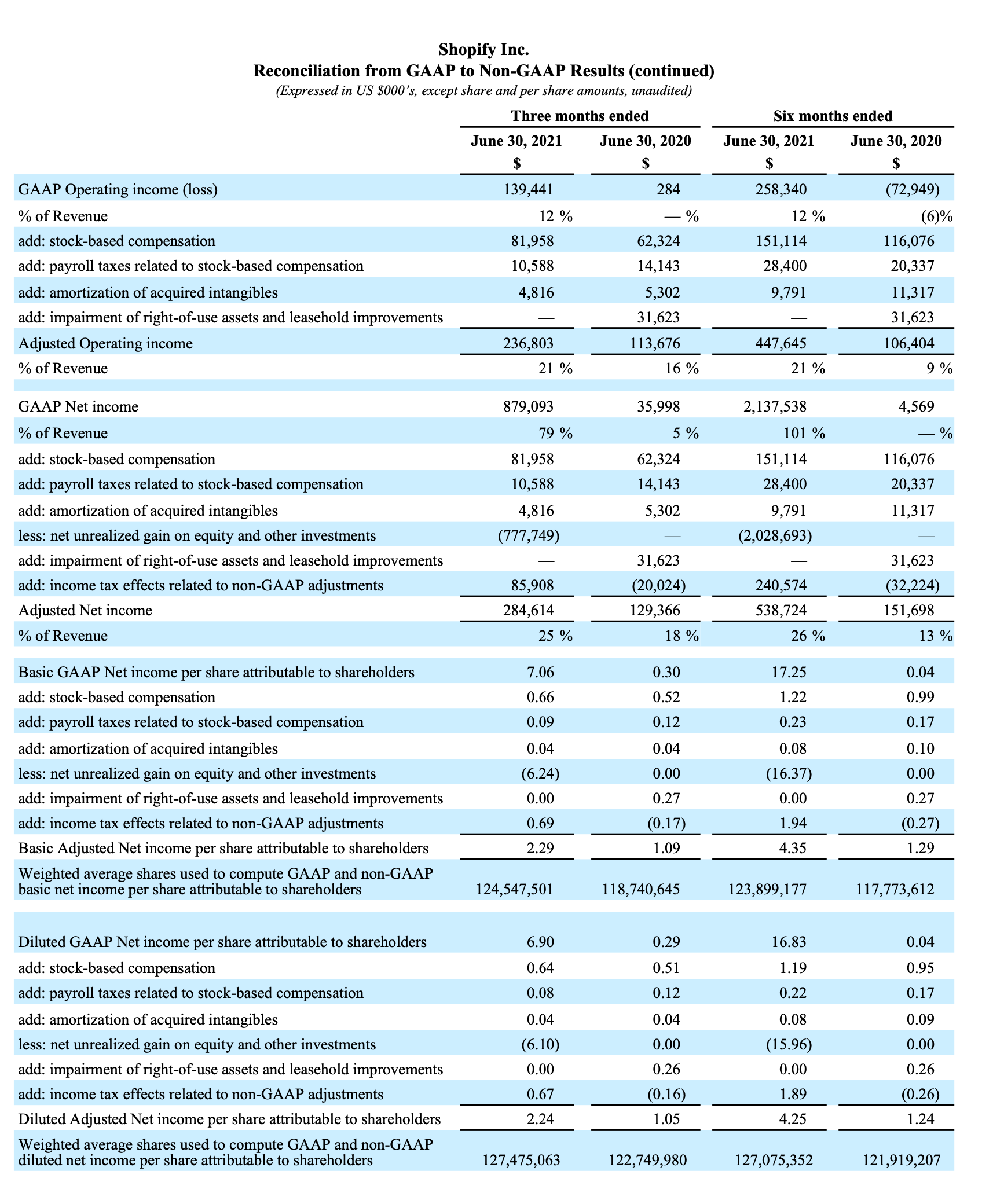

- Operating income for the second quarter of 2021 was $139.4 million, or 12% of revenue, versus income of $0.3 million, or 0% of revenue, for the comparable period a year ago.

- Adjusted operating income4 for the second quarter of 2021 was $236.8 million, or 21% of revenue, compared with adjusted operating income of $113.7 million or 16% of revenue in the second quarter of 2020.

- Net income for the second quarter of 2021 was $879.1 million, or $6.90 per diluted share, compared with net income of $36.0 million, or $0.29 per diluted share, for the second quarter of 2020. Q2 2021 net income includes a $778 million unrealized net gain on our equity investments.

- Adjusted net income4 for the second quarter of 2021 was $284.6 million, or $2.24 per diluted share, compared with adjusted net income of $129.4 million, or $1.05 per diluted share, for the second quarter of 2020.

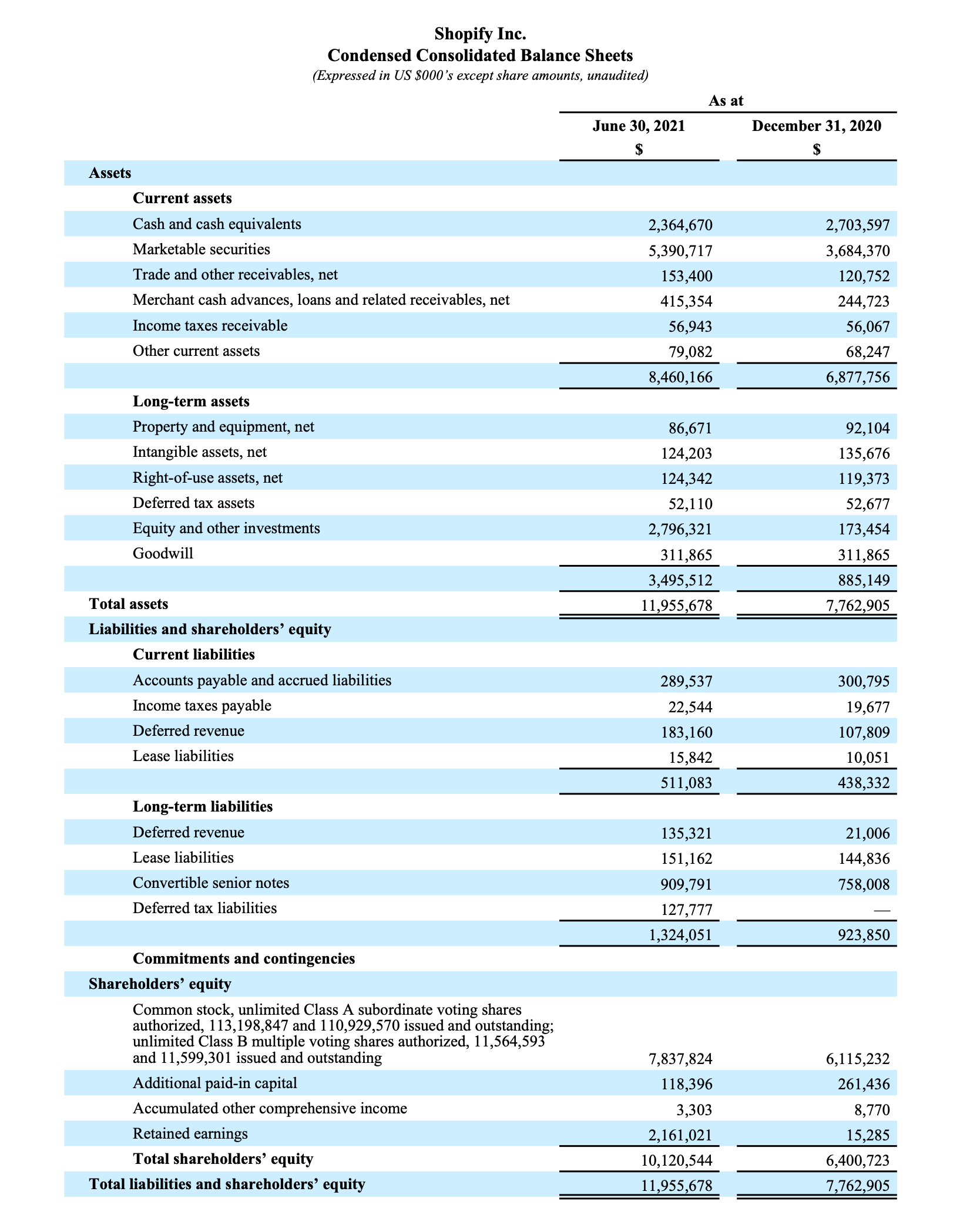

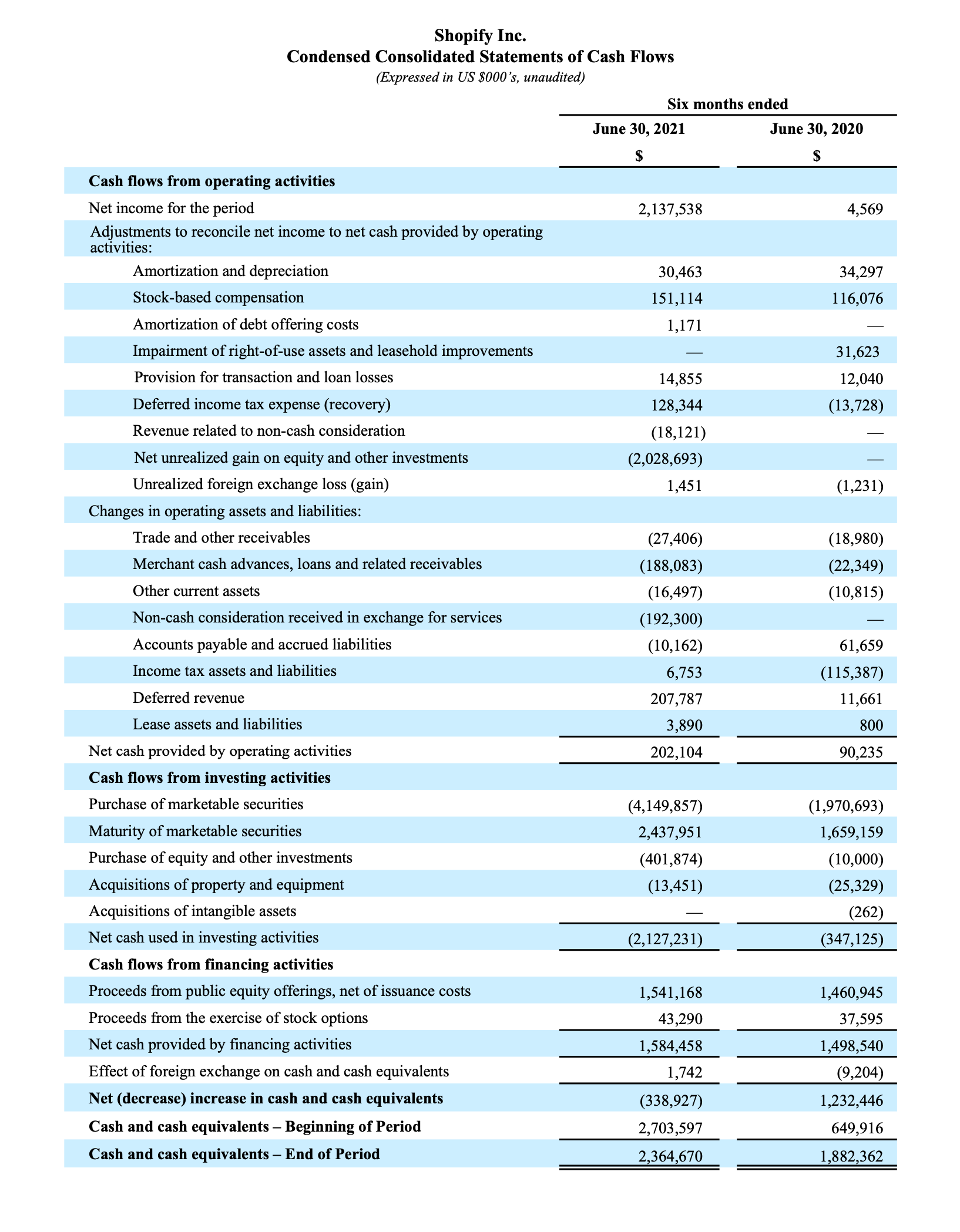

- At June 30, 2021, Shopify had $7.76 billion in cash, cash equivalents and marketable securities, compared with $6.39 billion at December 31, 2020.

Second-Quarter Business Highlights

-

Shopify held its virtual partner conference, Shopify Unite 2021, where we announced ways we are helping merchants and developers build the future of commerce on the internet. Key announcements included:

- More flexible and customizable storefronts: Merchants can more easily express their brands and create unique online experiences through our platform upgrade, Online Store 2.0, while new APIs and tooling enable developers to unlock rich platform features such as new cart functionality, selling plans, international pricing, and local pickup. Shopify also previewed Hydrogen, a toolkit for developers to build custom storefronts quickly and easily, and Oxygen, a fast, global, and optimized way to host these storefronts.

- Faster, scalable, and more customizable checkout: Shopify Checkout will be even faster, giving any shop the capacity to handle tens of thousands of purchases per minute; more scalable through the launch of our new Shopify Payments Platform, which enables developers to create payment gateways as Shopify apps; and easier to customize, allowing developers to securely build apps directly into Shopify Checkout.

- Updating our economic model to help scale our partner community: Starting in August for Apps, and September for Themes, developers will pay 0% rev share for the first $1 million they make annually on the platform, and will pay only 15% on revenue over $1 million annually.

- Shopify continued to build the foundation of Shopify Fulfillment Network, introducing features to help merchants manage the products fulfilled on our network, improve shipping speed and accuracy, and manage preferences, like staff notifications.

- Shopify added features and functionality to Shop, our mobile shopping assistant, including an analytics dashboard and automated marketing tools to support merchant sales efforts, and in-app cart and checkout and curated discovery filters for LGBTQ+ and Indigenous-owned businesses for a better shopping experience. At the end of Q2 2021, Shop had more than 118 million registered users, including buyers using Shop Pay as well as the Shop App, of which approximately 23 million were Monthly Active Users. At the end of June 2021, Shop Pay had facilitated nearly $30 billion in cumulative GMV since its launch in 2017.

- Shopify announced that Shop Pay will become available to all merchants selling in the U.S. on Facebook and Google, even if they don’t use Shopify’s online store, positioning Shop Pay to become the preferred checkout for all merchants, whether they are on Shopify’s platform or not.

- Shopify launched our integrated retail hardware with payments using our All-New POS software to retail merchants in Australia in May, enabling merchants in these regions to seamlessly bridge online and offline commerce.

- Shopify rolled out Shop Pay Installments to all merchants in the U.S., enabling merchants to provide buyers with increased flexibility and affordability at checkout. Our buy-now-pay-later product also unlocks significant benefits for merchants, including access to one of the largest U.S. consumer networks through Shop Pay, a seamless checkout experience with higher conversion and order values and lower abandoned carts, and direct integration of Shop Pay Installments with merchants’ Shopify stores.

- Merchants in the U.S., Canada, and the U.K. received a record $363 million in merchant cash advances and loans from Shopify Capital in the second quarter of 2021, an increase of 137% versus the $153 million received by U.S. merchants in the second quarter of last year. Shopify Capital has grown to approximately $2.3 billion in cumulative capital advanced since its launch in April 2016, approximately $415.4 million of which was outstanding on June 30, 2021.

- Shopify’s partner ecosystem continued to expand, as approximately 46,400 partners referred a merchant to Shopify over the past 12 months, up 53% compared with 30,300 over the 12 months ended June 30, 2020.

Outlook

The outlook that follows constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control. Please see "Forward-looking Statements" below.

In addition to the other assumptions and factors described in this press release, Shopify’s outlook assumes the continuation of growth trends in our industry, our ability to manage our growth effectively, the absence of material changes in our industry or the global economy and other assumptions related to the COVID-19 pandemic, which are described in detail below. The following statements supersede all prior statements made by Shopify and are based on current expectations. As these statements are forward-looking, actual results may differ materially.

These statements do not give effect to the potential impact of mergers, acquisitions, divestitures or business combinations that may be announced or closed after the date hereof. All numbers provided in this section are approximate.

Our outlook for the remainder of 2021 is consistent with our assumptions in February. We have seen an improvement in the overall economic environment through the first half of 2021, consumer spending beginning to rotate back to services and off-line retail, and ecommerce growing at a more normalized pace relative to 2020.

In view of these factors and Shopify’s performance for the six months ending June 30, 2021, we continue to expect to grow revenue rapidly in 2021, but at a lower rate than in 2020. For the full year 2021, we continue to expect the following:

- Subscriptions solutions revenue growth to be driven by more merchants around the world joining the platform in a number lower than the record in 2020, but higher than any year prior to 2020;

- The growth rates of subscription solutions and merchant solutions revenues to be more similar to each other than in the recent past, as we do not expect the surge in GMV that drove merchant solutions in 2020 to repeat; and,

- Merchant solutions revenue growth to be driven by continued GMV growth from existing merchants, new merchants joining the platform, and expanded adoption of Shopify’s growing menu of merchant solutions, including established offerings such as Shopify Payments, Shopify Shipping, and Shopify Capital, both geographically and as merchants grow into them, while newer solutions such as Shopify Fulfillment Network and 6 River Systems contribute nascent but incremental revenue in their early stages.

We expect that the first quarter will likely still contribute the smallest share of full-year revenue and the fourth quarter the largest, and that the revenue spread will be more evenly distributed across the four quarters than it has been historically.

We continue to expect rapid growth in gross profit dollars in 2021 and plan to continue reinvesting back into our business as aggressively as we can, with the year-over-year growth in operating expenses accelerating in Q3 and again in Q4. Due to the sustained momentum of digital commerce trends in the first half of 2021 combined with the U.S. stimulus distributed in March and April of 2021, Shopify generated higher-than-anticipated revenue while incurring lower-than-planned operating expenses as a percent of revenue in the first half of 2021. As a result, we now expect full-year 2021 adjusted operating income to be above the level we achieved in 2020.

For 2021, we continue to anticipate stock-based compensation expenses and related payroll taxes of $425 million and amortization of acquired intangibles of $21 million.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our second-quarter results today, July 28, 2021, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Second Quarter 2021 Interim Unaudited Condensed Consolidated Financial Statements and Notes and its Second Quarter 2021 Management's Discussion and Analysis are available on Shopify’s website at www.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading provider of essential internet infrastructure for commerce, offering trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Proudly founded in Ottawa, Shopify powers over 1.7 million businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Staples Canada, and many more. For more information, visit www.shopify.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted operating income, non-GAAP operating expenses, adjusted net income and adjusted net income per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes and amortization of acquired intangibles. Adjusted net income and adjusted net income per share also exclude unrealized gains on equity and other investments and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including statements regarding Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as “believe”, "continue", "will", “plan”, “anticipate”, "become", "enable", and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: (i) merchant acquisition and retention; (ii) managing our growth; (iii) our potential inability to compete successfully against current and future competitors; (iv) the security of personal information we store relating to merchants and their customers and consumers with whom we have a direct relationship; (v) our history of losses and our ability to maintain profitability; (vi) a disruption of service or security breach; (vii) our limited operating history in new markets and geographic regions; (viii) our ability to innovate; (ix) international sales and operations and the use of our platform in various countries; (x) our reliance on a single supplier to provide the technology we offer through Shopify Payments; (xi) our potential inability to hire, retain and motivate qualified personnel; (xii) our use of a single cloud-based platform to deliver our services; (xiii) uncertainty around the duration and scope of the COVID-19 pandemic and the impact of the pandemic and actions taken in response on global and regional economies and economic activity; (xiv) the reliance of our growth in part on the success of our strategic relationships with third parties; (xv) complex and changing laws and regulations worldwide; (xvi) our dependence on the continued services of management and other key employees; (xvii) our potential failure to effectively maintain, promote and enhance our brand; (xviii) payments processed through Shopify Payments; (xix) serious errors or defects in our software or hardware or issues with our hardware supply chain; (xx) our potential inability to achieve or maintain data transmission capacity; (xxi) activities of merchants or partners or the contents of merchants’ shops; (xxii) evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations may limit the use and adoption of our services; (xxiii) changes in tax laws or adverse outcomes related to our taxes; (xiv) other one-time events and other important factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

1. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

2. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month.

3. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments.

4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, unrealized gains on equity and other investments, and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information.

Shopify Announces Second-Quarter 2021 Financial Results.pdf