Merchants trust Shopify with more parts of their business in Q2 as GMV growth outpaces market

Shopify reports in U.S. dollars and in accordance with U.S. GAAP

Internet, Everywhere - July 27, 2022 - Shopify Inc. (NYSE, TSX: SHOP), a provider of essential internet infrastructure for commerce, announced today financial results for the quarter ended June 30, 2022.

“The superpowers Shopify continued to build for our merchants in Q2 serve them well across virtually any channel and in any environment,” said Harley Finkelstein, Shopify’s President. “Our incredible pace of innovation was highlighted this past quarter with Shopify Editions, a summary of 100+ new capabilities spanning B2B, POS Pro, Shopify Audiences and Shopify Markets, all designed to unlock even greater value across our entire platform and strengthen Shopify’s commerce operating system.”

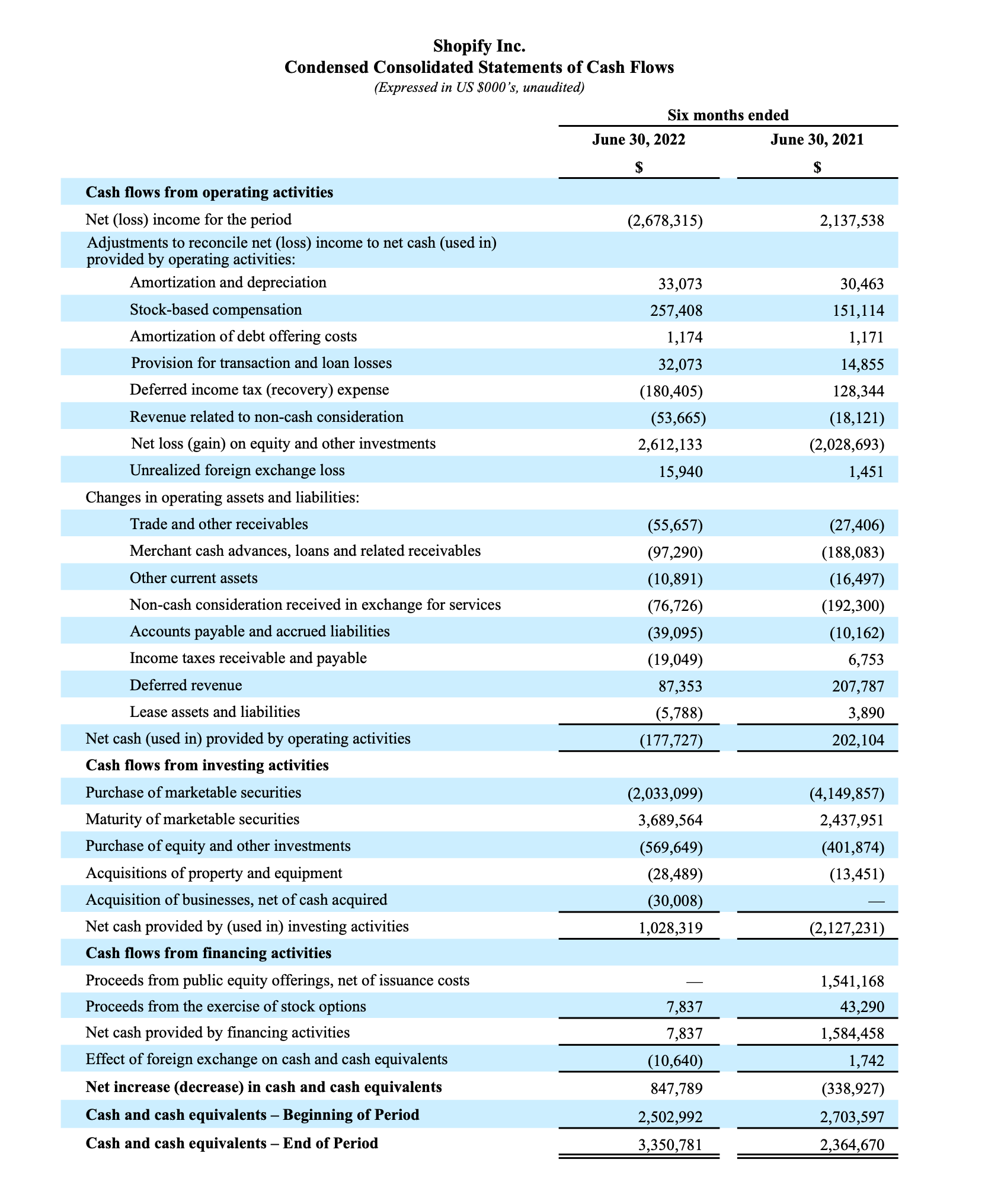

“While commerce through offline channels grew faster in Q2, where our exposure is lower but growing, we continued to see increased adoption of our solutions, enabling our merchants to remain agile against a challenging macro environment and highlighting the breadth and resilience of our business model,” said Amy Shapero, Shopify’s CFO. “Our merchants’ GMV growth continued to outpace the growth of the broader U.S. online and offline retail markets as consumers shopped across more surfaces. Our track record of prudent capital allocation toward opportunities that significantly expand the opportunity set for merchants, accelerate our product roadmap, or have strong paybacks from improved operating efficiency has served Shopify and our merchants well. We have recalibrated our team to build for long-term success, and will continue to operate with rigorous discipline, investing thoughtfully into the enormous opportunity ahead of us.”

Second-Quarter Financial Highlights

- Total revenue in the second quarter grew 16% year over year to $1.3 billion, which represents a three-year compound annual growth rate of 53%. Total reported revenue growth year-over-year was negatively impacted by approximately 1.5 percentage points given the significant strengthening of the U.S. dollar relative to foreign currencies in the second quarter.

- Monthly Recurring Revenue1 ("MRR") as of June 30, 2022 was $107.2 million. MRR increased 13% year over year, up from $95.1 million as of June 30, 2021 as more merchants joined the platform and the number of retail locations using POS Pro increased. Shopify Plus contributed $33.7 million, or 31%, of MRR compared with 26% of MRR as of June 30, 2021, as larger merchants seek out greater value from their digital platforms.

- Subscription Solutions revenue was $366.4 million, up 10% year over year, primarily due to more merchants joining the platform, and reflecting our change in terms to make selling in our app and theme stores free for partners up to their first million dollars annually, terms that were not in place until the third quarter of 2021.

- Gross Merchandise Volume2 ("GMV") for the second quarter was $46.9 billion, which represents a three- year compound annual growth rate of 50% and an increase of $4.7 billion, or 11% over the second quarter of 2021. Gross Payments Volume3 ("GPV") grew to $24.9 billion, which accounted for 53% of GMV processed in the quarter, versus $20.3 billion, or 48%, for the second quarter of 2021. GPV continued to benefit in the quarter from strong performance by merchants on Shopify Payments, growing adoption by new merchants and merchants on Shopify Plus, Shop Pay and Shopify Markets penetration gains, and continued adoption of our POS Pro hardware with integrated payments.

- Merchant Solutions revenue was $928.6 million, up 18% year over year, driven primarily by the growth of GMV and the continued solid uptake of merchant solutions such as Shopify Payments, Shopify Capital, and Shopify Markets. Merchant Solutions revenue growth year-over-year was negatively impacted by approximately two percentage points due to the strengthening U.S. dollar.

- Gross profit dollars grew 6% to $655.6 million in the second quarter of 2022, compared with $620.9 million for the second quarter of 2021, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins in Shopify Payments due to merchant and card mix, and increased investments in our cloud infrastructure.

- Adjusted gross profit4 dollars grew 6% to $665.0 million in the second quarter of 2022, compared with $627.0 million for the second quarter of 2021.

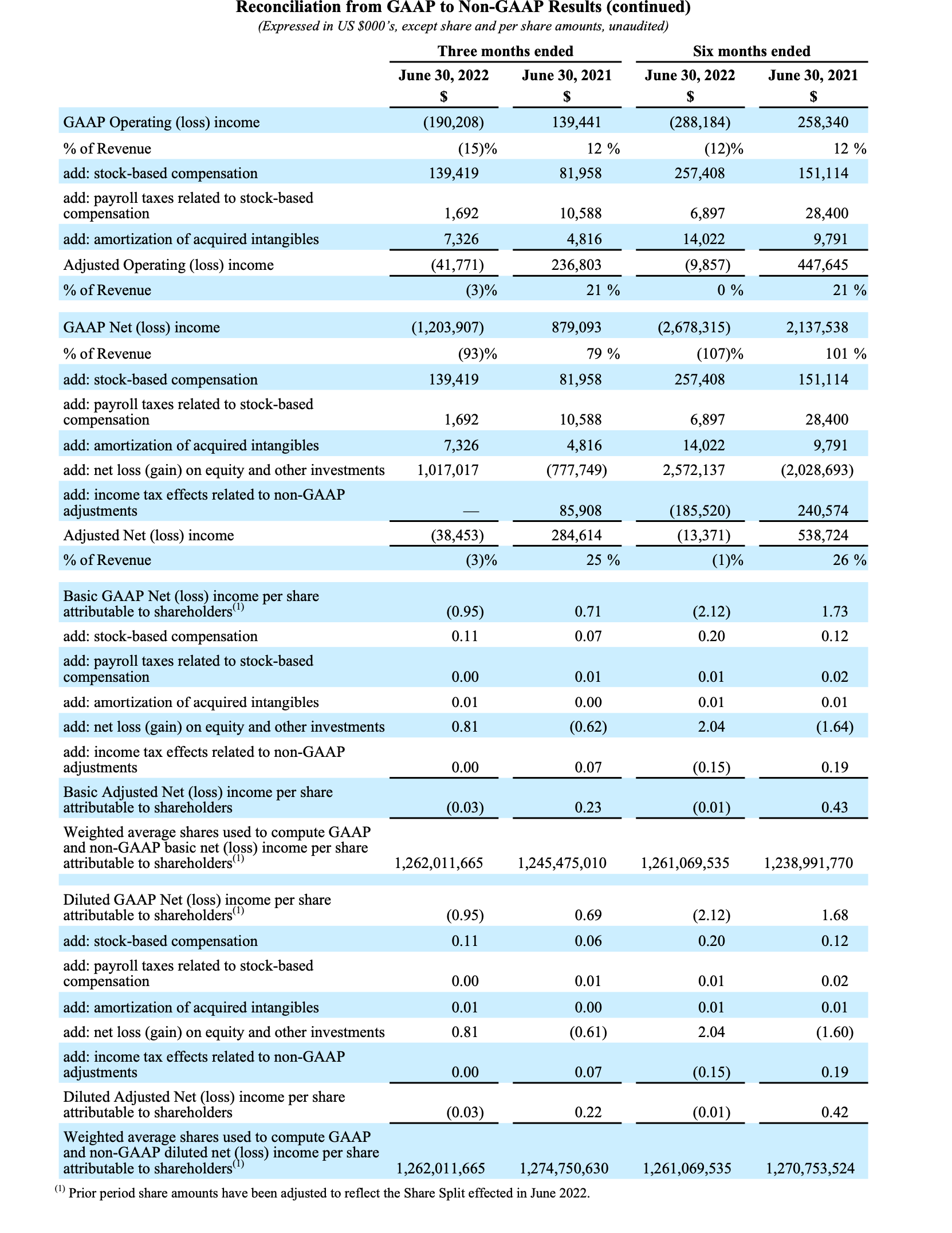

- Operating loss for the second quarter of 2022 was $190.2 million, or 15% of revenue, versus income of $139.4 million, or 12% of revenue, for the comparable period a year ago.

- Adjusted operating loss4 for the second quarter of 2022 was $41.8 million, or 3% of revenue, compared with adjusted operating income of $236.8 million or 21% of revenue in the second quarter of 2021. The difference primarily reflects the expansion of our R&D and sales and marketing teams, and the step up in our international marketing efforts and offline performance marketing initiatives.

- Net loss for the second quarter of 2022 was $1.2 billion, or $0.95 per basic and diluted share, compared with net income of $0.9 billion, or $0.695 per diluted share, for the second quarter of 2021. Second-quarter 2022 net loss includes a $1.0 billion net unrealized loss on our equity and other investments, while our net income in the second quarter of 2021 included a $0.8 billion net unrealized gain from equity and other investments.

- Adjusted net loss4 for the second quarter of 2022 was $38.5 million, or $0.03 per basic and diluted share, compared with adjusted net income of $284.6 million, or $0.225 per diluted share, for the second quarter of 2021.

- At June 30, 2022, Shopify had $6.95 billion in cash, cash equivalents and marketable securities, compared with $7.77 billion at December 31, 2021.

Second-Quarter Business Highlights

-

Shopify launched Shopify Editions, our new semi-annual product showcase that features new launches and improvements across the entire platform that is powering the Connect-to-Consumer era of commerce. Over 100 updates were featured in our Summer ‘22 Edition, including the following:

- B2B functionality integrated directly into the Shopify platform, making it easier for Shopify Plus brands to sell to other businesses via the same store they use for direct-to-consumer commerce.

- Twitter Shopping channel, which enables merchants to reach consumers directly from their Twitter profiles, with buyers seeing products and pricing without having to leave the app.

- Shopify Functions, which enables brands to customize out-of-the-box Shopify features to meet their unique needs without ever touching code.

- Tap to Pay on iPhone (in early access), allowing merchants to easily expand into offline retail with their iPhone, meaning no extra hardware or upfront investment required.

- Google local inventory sync, so merchants can sync location and inventory levels directly from within the Shopify Google Channel account and automatically let nearby customers know when a product is available in store across Google surfaces, making it easier to shop and support local brands.

- Tokengated commerce, enabling merchants to deepen connections with new fans and VIPs by giving NFT holders exclusive access to products, perks, and experiences across online, mobile, and offline surfaces.

- Shopify launched Shopify Audiences, a marketing tool powered by an audience network and machine learning that helps merchants find high-intent buyers for their products. At launch, merchants can sync Shopify Audiences with Facebook and Instagram and are working to extend to platforms such as TikTok, Snap, Pinterest, Microsoft, Criteo, and others.

- Shopify continued to build Shopify Fulfillment Network to offer our merchants and their buyers simple, fast, and affordable fulfillment. We completed the rollout of Shopify’s warehouse management system to our fulfillment network and introduced our delivery badge, Shop Promise, into early access which will enable merchants to offer buyers visibility into when they will receive their orders.

- Shopify launched our integrated hardware with payments to retail merchants in Italy in June and Singapore in July, bringing the total number of countries in which Shopify POS hardware is available to 13.

- Shopify launched Shopify Payments in France expanding the availability of Shopify Payments to 18 countries.

- Merchants in the U.S., Canada, and the U.K. received $416.4 million in merchant cash advances and loans from Shopify Capital in the second quarter of 2022, an increase of 15% versus the $363.0 million funded in the second quarter of last year. Shopify Capital has grown to $3.8 billion in cumulative capital funded since its launch in April 2016, approximately $537.8 million of which was outstanding on June 30, 2022.

- Shopify completed its ten-to-one share split and creation of the Founder share following approval by the company’s shareholders at its Annual General and Special Meeting held on June 7, 2022.

Subsequent to Second Quarter 2022

- Shopify closed its acquisition of ecommerce fulfillment technology company, Deliverr, on July 8, 2022. With the addition of Deliverr's world-class software, talent, data, and scale, Shopify Fulfillment Network will offer merchants a one-stop shop for their logistics needs, from initial receipt of inventory to smart distribution, through to fast delivery and easy returns.

- Shopify partnered with YouTube to launch YouTube Shopping, enabling Shopify’s millions of merchants around the world to reach YouTube’s over two billion monthly logged-in users. With the launch of YouTube Shopping on Shopify, merchants can easily integrate products from their online store into live streams, videos and into a new store tab on their YouTube channel to feature their entire selection of products.

- As ecommerce has reverted to a level slightly higher than its pre-COVID trend, in an effort to recalibrate our operations, Shopify took steps to streamline its workforce in July, reducing its total headcount by approximately 10%. After expanding the company in anticipation of rapid and sustained structural ecommerce market expansion, which has not materialized, we are recalibrating to meet the new reality.

2022 Outlook

The following outlook supersedes all prior statements made by Shopify and are based on current expectations. These statements constitute forward-looking information within the meaning of applicable securities laws and are based on a number of assumptions and risks, many of which are beyond our control. As these statements are forward-looking, actual results could vary materially from our expectations. Please see "Forward-looking Statements" below for more information.

We have grown our adjusted operating income over the past five years through 2021. We now expect 2022 will end up being different, more of a transition year, in which ecommerce has largely reset to the pre-COVID trend line and is now pressured by persistent high inflation. We expect our multi-channel superpowers and strong value proposition will continue to help our merchants in this environment, and we are excited about our critical investments, like Deliverr, that we believe will position us well for the future of commerce.

Our financial outlook for the rest of 2022, which includes the impact of Deliverr and our new compensation system that we expect to implement in our third quarter, assumes that higher inflation will persist for the foreseeable future and, combined with rising interest rates, will pressure consumers’ wallets for purchases of goods.

For 2022, we expect:

- GMV growth, though impacted by persistent inflation, will continue to outperform the broader retail market in the second half of 2022;

- Merchant Solutions revenue will continue to grow as a percentage of GMV, driven by Shopify Payments, Shopify Capital, Shopify Markets, Shop Pay Installments, and Shopify Fulfillment (including Deliverr), and continue to benefit from the growth of partner revenue;

- The number of new merchants joining the platform in the second half of 2022 will be higher than in the first half of 2022 as our localized subscription pricing and other commercial initiatives gain traction;

- Merchant Solutions revenue growth year-over-year will be more than double that of Subscription Solutions growth for full year 2022;

- Both GMV and total revenue in 2022 to be more evenly distributed across the four quarters, similar to 2021, given the increasing pressure on consumer spending on goods and currency headwinds from the stronger U.S. dollar we are expecting in the back half of this year;

- Because of this larger mix of Merchant Solutions contributing to overall revenue and Deliverr, which we expect to be dilutive, gross profit dollar growth will trail revenue growth; and

- Operating expense growth, excluding one-time items, to meaningfully decelerate year over year in the third quarter, and again in the fourth quarter.

Factoring in these expectations, we expect to generate an adjusted operating loss for the second half of 2022, with our third-quarter adjusted operating loss, excluding severance costs, expected to materially increase over the second quarter, reflecting time needed for the streamlining of our operations to take effect, the implementation of our new compensation framework, the first quarter of Deliverr operations, including approximately 450 team members, and related integration costs, and up to an estimated 50 million dollars for certain other operating items associated with these and other areas. As we decelerate operating expense growth into the fourth quarter, and with its higher seasonal GMV and revenue, we expect an adjusted operating loss in the fourth quarter that is significantly smaller than in the third quarter, but larger than in the second quarter.

Finally, the estimates of stock-based compensation and related payroll taxes, capex and amortization of acquired intangibles are now 750 million dollars, 200 million dollars and 62 million dollars, respectively.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our second-quarter results today, July 27, 2022, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Second Quarter 2022 Interim Unaudited Condensed Consolidated Financial Statements and Notes and its Second Quarter 2022 Management's Discussion and Analysis are available on Shopify’s website at https://investors.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading provider of essential internet infrastructure for commerce, offering trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Proudly founded in Ottawa, Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Tupperware, FTD, Netflix, FIGS, and many more. For more information, visit www.shopify.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted operating income/loss, adjusted net income/loss and adjusted net income/loss per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes, and amortization of acquired intangibles. Adjusted net income/loss and adjusted net income/loss per share also exclude unrealized and realized gains and losses on equity and other investments and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as "continue", "will", “plan”, “anticipate”, "become", "enable", and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: sustaining our rapid growth; managing our growth; our potential inability to compete successfully against current and future competitors; the security of personal information we store relating to merchants and their buyers, as well as consumers with whom we have a direct relationship including users of our apps; a denial of service attack or security breach; our ability to innovate; our limited operating history in new and developing markets and geographic regions; international sales and operations and the use of our platform in various countries; our current reliance on a single supplier to provide the technology we offer through Shopify Payments; the reliance of our growth in part on the success of our strategic relationships with third parties; our potential inability to hire, retain and motivate qualified personnel; our use of a single cloud-based platform to deliver our services; complex and changing laws and regulations worldwide; our dependence on the continued services of our senior management and other key employees; the COVID-19 pandemic and its impact on our business, financial condition and results of operations including the impact of measures taken to contain the virus and the impact on the global economy and consumer spending on our merchants' and partners' ecosystem; payments processed through Shopify Payments, Shop Pay Installments, or payments processed or funds managed through Shopify Balance; our history of losses and our ability to maintain profitability; our potential failure to effectively maintain, promote and enhance our brand; serious errors or defects in our software or hardware; our potential inability to achieve or maintain data transmission capacity; activities of merchants or partners or the content of merchants' shops and our ability to detect and address unauthorized activity on our platform; evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations that may limit the use and adoption of our services; acquisitions and investments, including strategic investments; our ability to successfully scale, optimize and operate Shopify Fulfillment Network; risks associated with Shopify Capital, and offering financing to merchants; potential claims by third parties of intellectual property infringement or other third party or governmental claims, litigation, disputes, or other proceedings; our reliance on computer hardware, purchased or leased, software licensed from and services rendered by third parties, in order to provide our solutions and run our business, sometimes by a single-source supplier; the impact of worldwide economic conditions, such as economic impacts due to the Russian invasion of Ukraine, including the resulting effect on spending by small and medium-sized businesses or their buyers; manufacturing and supply chain risks; unanticipated changes in tax laws or adverse outcomes resulting from examination of our income or other tax returns; being required to collect federal, state, provincial or local business taxes, sales and use taxes or other indirect taxes in additional jurisdictions on transactions by our merchants; the interoperability of our platform with mobile devices and operating systems; changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers; our potential inability to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third parties from making unauthorized use of our technology; our pricing decisions for our solutions, including localized pricing for different markets; our use of open source software; seasonal fluctuations; exchange rate fluctuations that may negatively affect our results of operations; our dependence upon buyers’ and merchants’ access to, and willingness to use, the internet for commerce; provisions of our financial instruments including our notes; our potential inability to raise additional funds as may be needed to pursue our growth strategy or continue our operations, on favorable terms or at all; our tax loss carryforwards; the ownership of our shares; our sensitivity to interest rate fluctuations; and our concentration of credit risk, and the ability to mitigate that risk using third parties, and the risk of inflation; and other one-time events and other important factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

1. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month. 2. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

3. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments. 4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, unrealized and realized gains and losses on equity and other investments, and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information. 5. Prior period per share amounts have been adjusted to reflect the ten-for-one share split effected in June 2022.

Shopify Reports Second Quarter 2022 Financial Results.pdf