GMV growth fueled by omnichannel capabilities and merchants adopting more solutions to run their businesses

Shopify reports in U.S. dollars and in accordance with U.S. GAAP

Internet, Everywhere - October 27, 2022 - Shopify Inc. (NYSE, TSX: SHOP), a provider of essential internet infrastructure for commerce, announced today financial results for the quarter ended September 30, 2022.

“Shopify is the central nervous system that powers millions of businesses around the world. During Q3, merchants continued to recognize Shopify's exceptional value and increased their adoption of our essential tools and innovative solutions. Our merchant solutions revenue as a percentage of GMV - or Merchant Solutions attach rate - climbed to 2.14%, the highest level in Shopify’s history,” said Harley Finkelstein, Shopify’s President. “We’re preparing our merchants for what’s ahead. The simplicity of our technology and the extraordinary consumer experience it offers are part of our merchants’ superpowers as they gear up for the busiest shopping season of the year.”

“In Q3, we delivered another solid quarter of GMV, revenue, and gross profit dollar growth against the high inflationary environment. From an operational perspective, we recalibrated our organizational structure, successfully rolled out a new compensation framework, and began integrating Deliverr into Shopify,” said Amy Shapero, Shopify’s CFO. “Looking ahead, the flexibility of our platform, breadth of solutions, pace of innovation, and disciplined investment approach position Shopify well to realize the enormous opportunity ahead.”

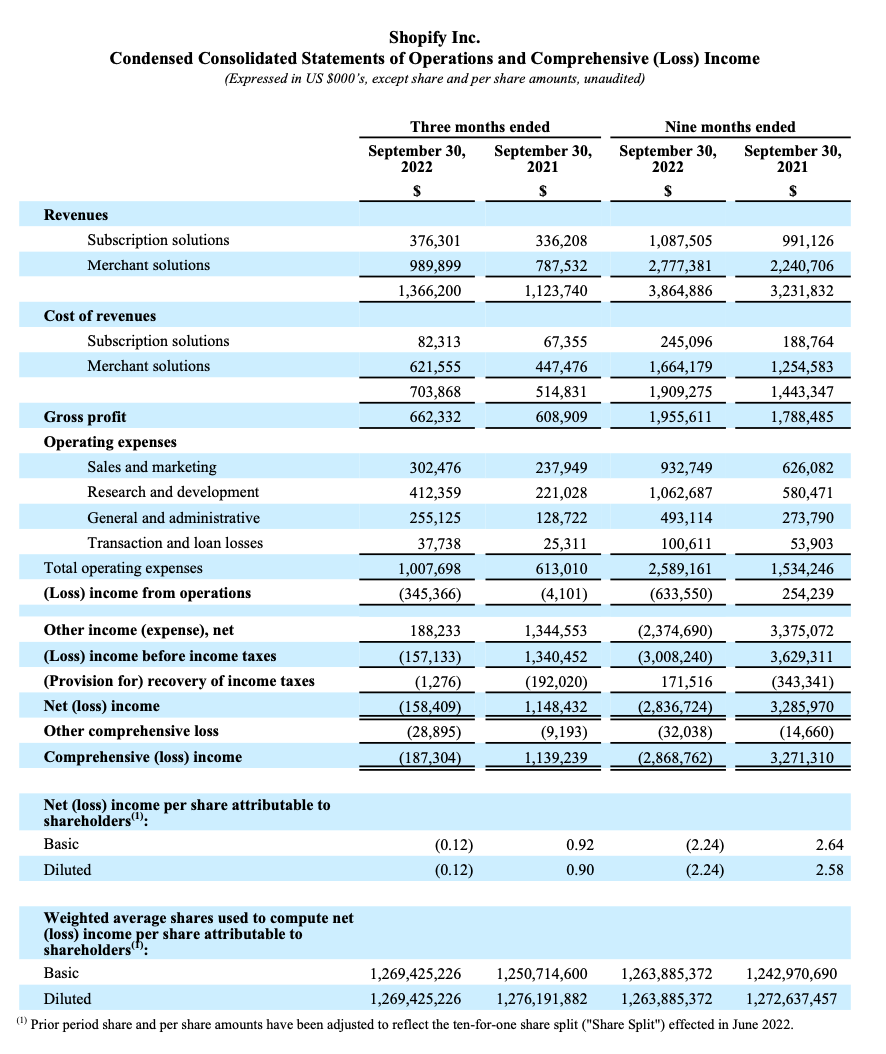

Third Quarter Financial Highlights

- Total revenue increased 22% to $1.4 billion compared to the prior year, which was negatively impacted by approximately 2 percentage points given the significant strengthening of the U.S. dollar relative to foreign currencies in the third quarter of 2021. On a three-year basis, the total revenue CAGR was 52%.

- Monthly Recurring Revenue1("MRR") as of September 30, 2022 increased 8% to $107.0 million compared to the prior year. The gains year over year in the number of Shopify Plus merchants on the platform and the thousands of additional retail locations utilizing POS Pro were partially offset by the impact of the free and paid trial experiences launched in the quarter. These trial programs are immaterial to MRR until those merchants convert to one of our non-Plus subscriptions. Shopify Plus contributed $35.1 million, or 33%, of MRR compared with 28% of MRR as of September 30, 2021.

- Subscription Solutions revenue increased 12% to $376.3 million compared to the prior year, primarily due to growth in MRR and reflecting lapping of our change in terms to make selling in our app and theme stores free for partners up to their first million dollars annually, terms that we put in place in the middle of the third quarter of 2021.

- Gross Merchandise Volume2("GMV") increased 11% to $46.2 billion, an increase of $4.4 billion over the third quarter of 2021. Gross Payments Volume3 ("GPV") grew to $25.0 billion, representing 54% of GMV processed in the quarter, versus $20.5 billion, or 49%, for the third quarter of 2021. GPV continued to benefit in the quarter from strong performance by merchants on Shopify Payments of which an increasing percentage is Shopify Plus GMV, new merchant adoption both in North America and internationally, penetration gains within Shop Pay and the expanded availability of our POS Pro hardware with integrated payments.

- Merchant Solutions revenue increased 26% to $989.9 million compared to the prior year, driven primarily by the growth of GMV and merchants continuing to utilize our solutions to run greater parts of their business. The primary drivers of the growth include an increased GMV penetration of Shopify Payments, Shopify Capital, and Shopify Markets, greater revenue contribution from partners, and the contribution from the first quarter of Deliverr. Excluding Deliverr, Merchant Solutions revenue increased 21 percent year over year. Merchant Solutions revenue growth was negatively impacted by approximately 3 percentage points due to the strengthening U.S. dollar compared to the prior year.

- Gross profit dollars grew 9% to $662.3 million, compared to the prior year, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins from Shopify Payments and Deliverr revenue as well as increased investments in our cloud infrastructure. On a three-year basis, the gross profit CAGR was 45%.

- Adjusted gross profit4 dollars grew 11% to $681.8 million, compared to the prior year. On a three-year basis, the adjusted gross profit CAGR was 46%.

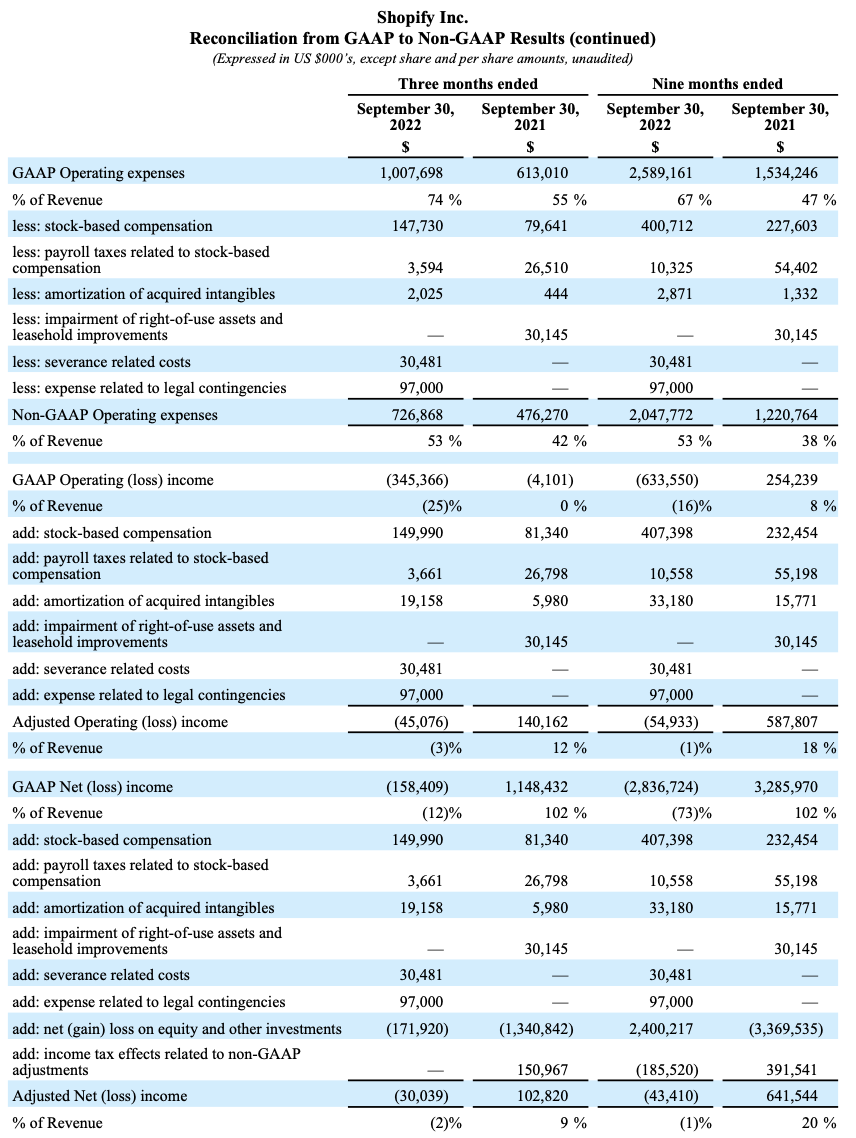

- Operating loss was $345.4 million, or 25% of revenue, versus a loss of $4.1 million, or 0.4% of revenue, for the comparable period a year ago.

- Adjusted operating loss4 was $45.1 million, or 3% of revenue, compared with adjusted operating income of $140.2 million or 12% of revenue in the third quarter of 2021. The difference primarily reflects increases in headcount including Deliverr, and to a lesser extent changes to our compensation framework. Additionally, third quarter 2022 adjusted operating loss excludes one-time charges from severance related costs connected to the workforce reduction announced in July and two accruals for pending litigation cases.

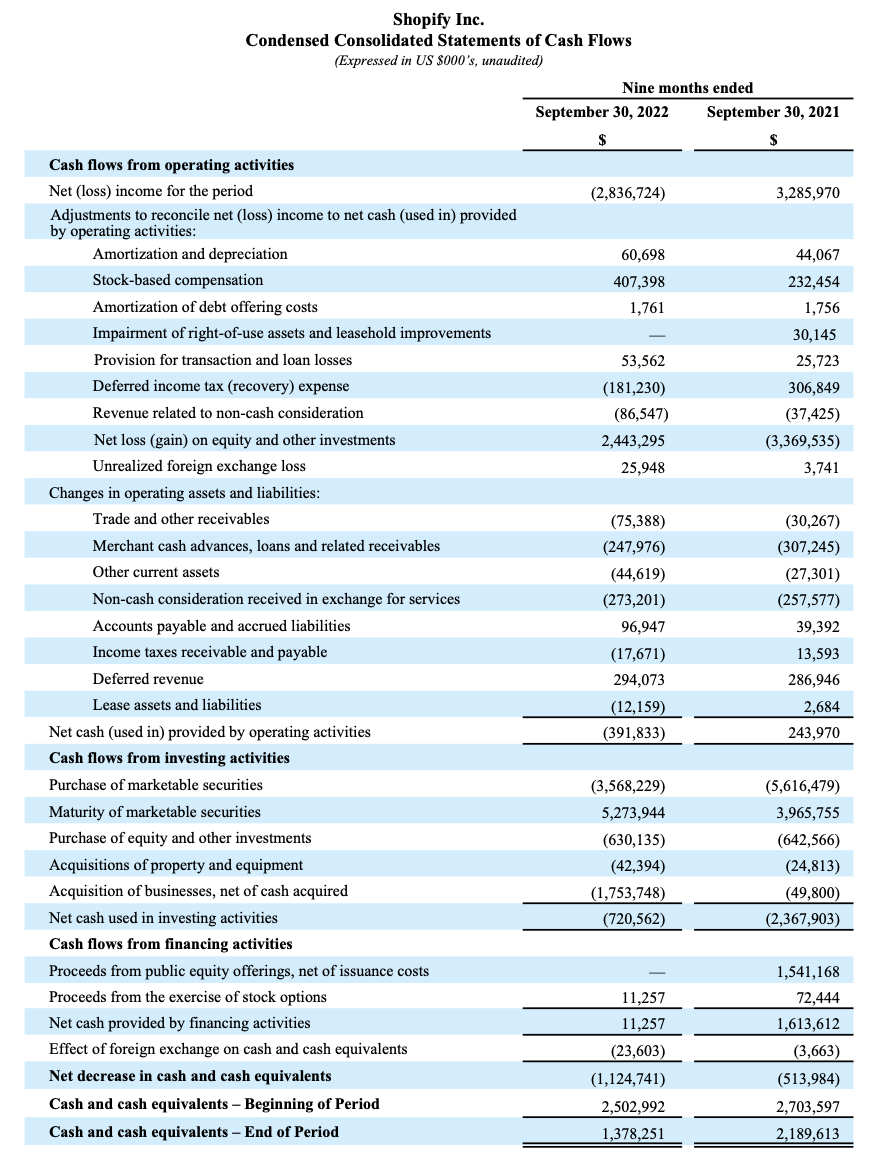

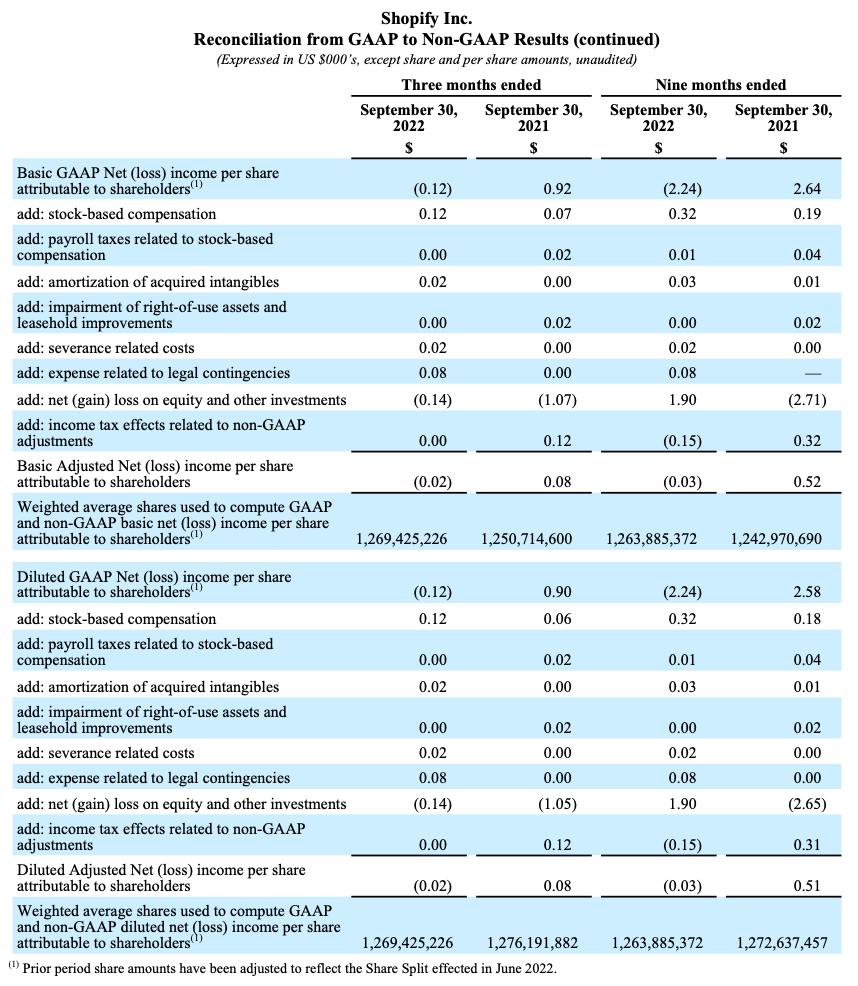

- Net loss was $158.4 million, or loss of $0.12 per basic and diluted share, compared with net income of $1.1 billion, or $0.905 per diluted share for the third quarter of 2021. Third quarter 2022 net loss includes a $171.9 million net gain on our equity and other investments, while our net income in the third quarter of 2021 included a $1.3 billion net unrealized gain from equity and other investments.

- Adjusted net loss4 was $30.0 million, or loss of $0.02 per basic and diluted share, compared with adjusted net income of $102.8 million, or $0.085 per diluted share, for the third quarter of 2021.

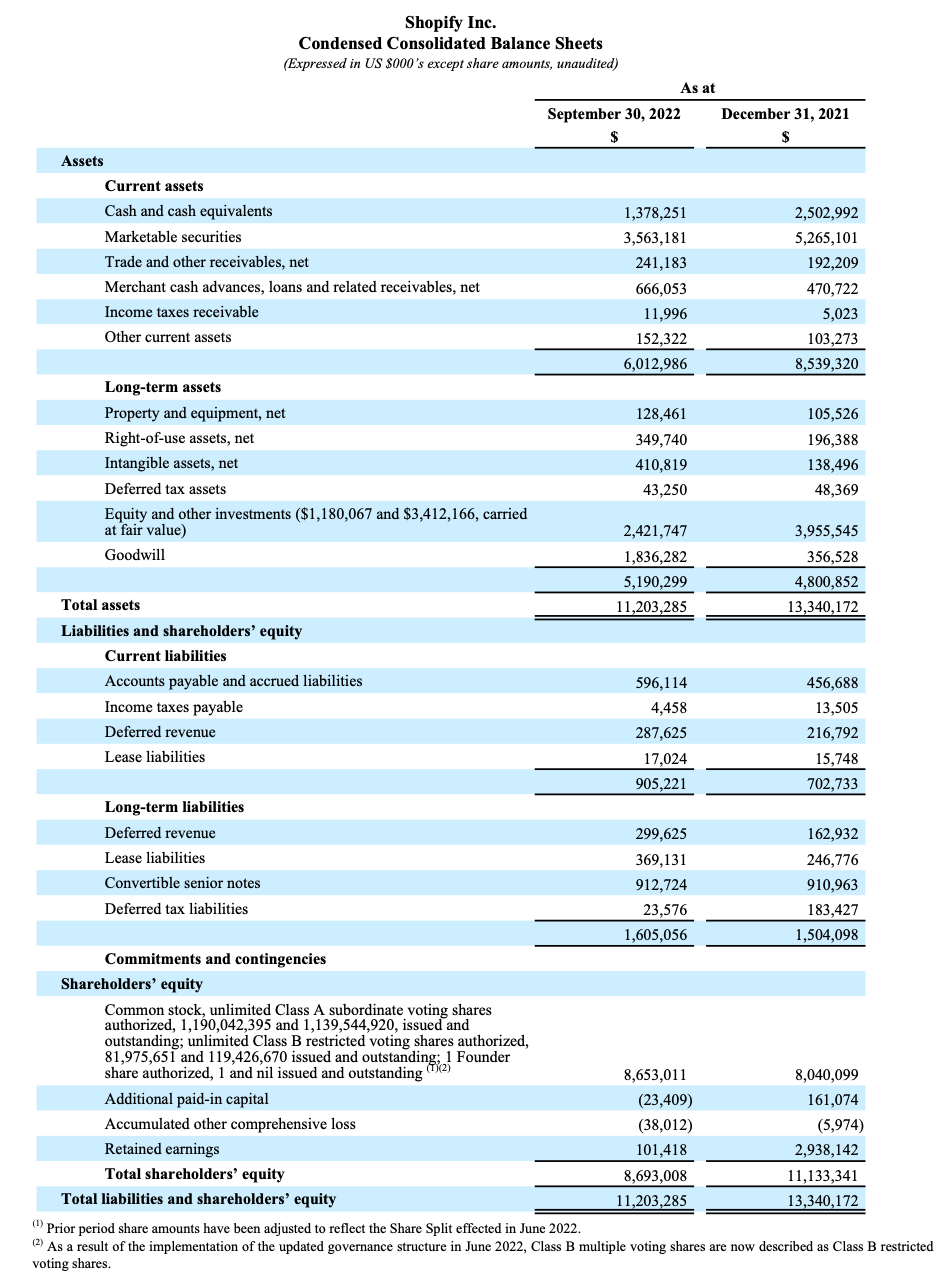

- At September 30, 2022, Shopify had $4.9 billion in cash, cash equivalents and marketable securities, compared with $7.8 billion at December 31, 2021.

Third Quarter Business Highlights

Shopify’s commerce operating system offers mission-critical functionality for businesses of all sizes in any macro environment. 2022 is an investment year for Shopify focused on four key themes - building buyer relationships, going global, going from first sale to full scale, and simplifying logistics.

-

Build buyer relationships through multi-channel expansion:

- Shopify launched Shopify Collabs, a sales channel for merchants to find and collaborate with creators to promote products to new audiences. For creators, the app provides accessibility to promote new products and grow their business.

- Shopify launched POS Go, innovative hardware is an all-in-one mobile POS device. Merchants can scan barcodes, accept tap, chip, and swipe payments, and use Shopify POS all from one handheld device.

-

Reducing barriers as Shopify helps merchants go global:

- Building on the success of Shopify Markets, Shopify introduced Shopify Markets Pro, a native merchant of record product that enables merchants to enter 150+ markets overnight. Markets Pro makes it easy to expand and succeed globally by removing the operational hassle of duty and tax compliance, regulations management, foreign exchange risk and fraud, while creating a great buyer experience with local currency, payment methods, duties paid upfront, and discounted DHL express shipping rates.

- Shopify launched Shopify Payments in Finland, Czech Republic, Switzerland and Portugal, expanding the availability of Shopify Payments to 22 countries.

- Shopify launched our integrated hardware with payments to retail merchants in Singapore and Finland, bringing the total number of countries in which Shopify POS hardware is available to 14.

-

Enabling first sale to full scale:

- Shopify Capital launched into Australia in Q3, expanding the availability of Shopify Capital to four countries. Merchants in these countries received $507.6 million in merchant cash advances and loans from Shopify Capital in the third quarter of 2022, an increase of 29% versus the $393.6 million funded in the third quarter of last year. Shopify Capital has grown to $4.3 billion in cumulative capital funded since its launch in April 2016, approximately $666.1 million of which was outstanding on September 30, 2022.

-

Simplify logistics through the Shopify Fulfillment Network:

- Shopify closed its acquisition of ecommerce fulfillment technology company, Deliverr, on July 8, 2022. With the integration underway, Shopify is expanding its logistics solutions and capacity for merchants from initial receipt of inventory to smart distribution, through to fast and reliable delivery.

- Shopify completed the rollout of Shop Promise to all SFN merchants in the quarter. Shop Promise is a consumer-facing badge indicating fast and reliable delivery, across Shopify’s Online Store and other popular D2C channels.

- Implemented a market-competitive compensation system (Flex Comp) to recruit, reward and retain the best talent in the world that gives employees greater agency and clarity on how they are compensated across base pay and equity.

2022 Outlook

The following outlook supersedes all prior statements made by Shopify and are based on current expectations. These statements constitute forward-looking information within the meaning of applicable securities laws and are based on a number of assumptions and risks, many of which are beyond our control. As these statements are forward-looking, actual results could vary materially from our expectations. Please see "Forward-looking Statements" below for more information.

Our financial outlook for the rest of 2022, which includes the expected impact of Deliverr, our new compensation system, and currency headwinds from the stronger U.S. dollar, assumes higher inflation and rising interest rates will continue to negatively affect the consumer’s purchasing power of discretionary goods and services.

For 2022, we now expect:

- GMV growth will continue to outperform the broader U.S. retail market in the fourth quarter aided by our omnichannel capabilities;

- Merchant Solutions revenue growth year-over-year will be more than double that of Subscription Solutions revenue growth for full year 2022;

- Both GMV and total revenue in 2022 to be more evenly distributed across the four quarters, similar to 2021;

- Because of this larger mix of Merchant Solutions contributing to overall revenue and the dilutive impact of Deliverr, gross profit dollar growth will meaningfully trail revenue growth; and,

- We continue to anticipate that operating expense growth year-over-year in Q4 will sequentially decelerate from Q3.

Considering all of these expectations, we continue to expect an adjusted operating loss for the full year. For the fourth quarter, based on our updated outlook, we now expect an adjusted operating loss amount that will be fairly comparable to the adjusted operating loss amount in the third quarter.

Finally, the full year estimates of stock-based compensation and related payroll taxes, capex and amortization of acquired intangibles are $575 million, $125 million and $55 million, respectively.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our third-quarter results today, October 27, 2022, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Third Quarter 2022 Interim Unaudited Condensed Consolidated Financial Statements and Notes and its Third Quarter 2022 Management's Discussion and Analysis are available on Shopify’s website at https://investors.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading provider of essential internet infrastructure for commerce, offering trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Proudly founded in Ottawa, Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Tupperware, FTD, Netflix, FIGS, and many more. For more information, visit www.shopify.com.

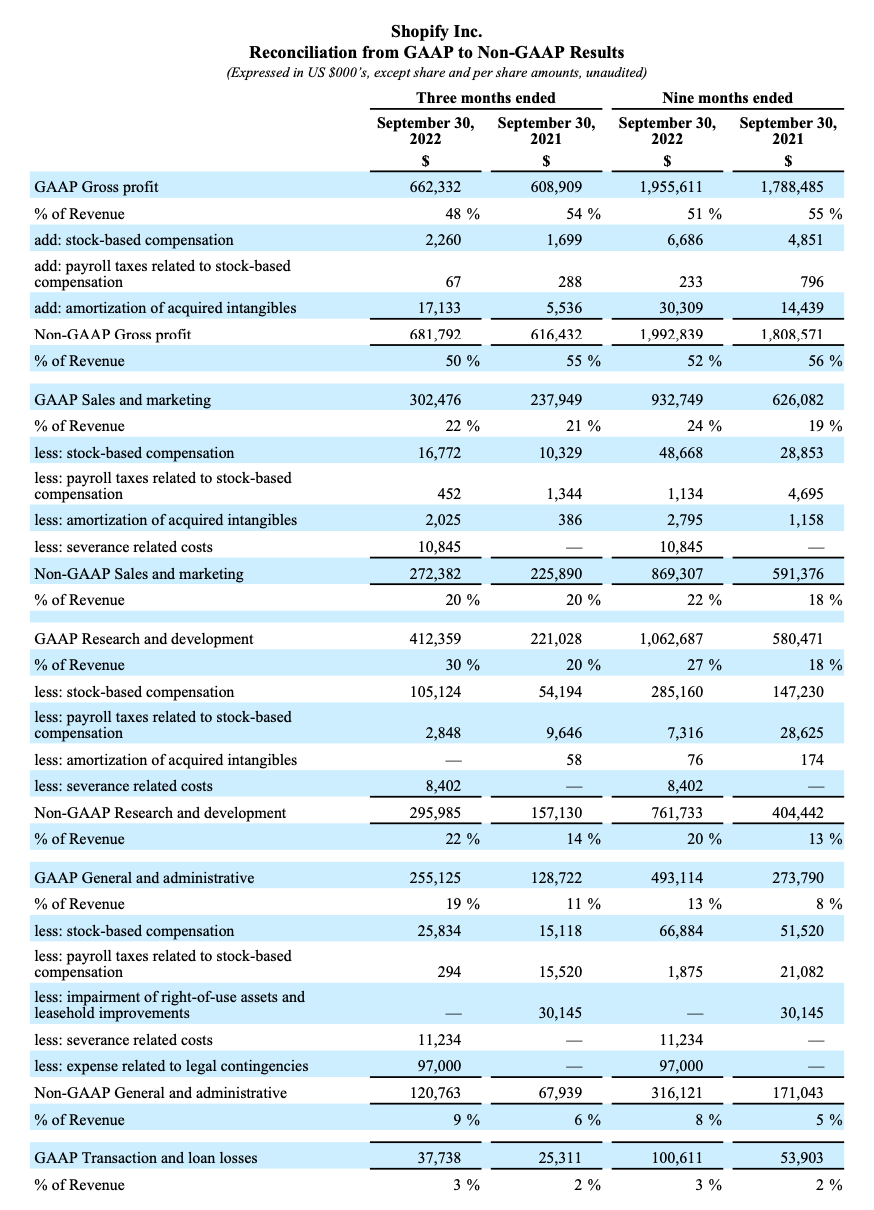

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted operating income/loss, adjusted net income/loss and adjusted net income/loss per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, employee severance relating to the July 2022 reduction in workforce, the provision associated with two litigation-related accruals in the third quarter of 2022, and a real estate-related impairment charge in the third quarter of 2021. Adjusted net income/loss and adjusted net income/loss per share also exclude unrealized and realized gains and losses on equity and other investments and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as "continue", “may”, "will", “could”, “plan”, “anticipate”, "become", "enable", “believe” and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: sustaining our rapid growth; managing our growth; our potential inability to compete successfully against current and future competitors; the security of personal information we store relating to merchants and their buyers, as well as consumers with whom we have a direct relationship including users of our apps; a denial of service attack or security breach; our ability to innovate; our limited operating history in new and developing markets and geographic regions; international sales and operations and the use of our platform in various countries; our current reliance on a single supplier to provide the technology we offer through Shopify Payments; the reliance of our growth in part on the success of our strategic relationships with third parties; our potential inability to hire, retain and motivate qualified personnel; our use of a single cloud-based platform to deliver our services; complex and changing laws and regulations worldwide; our dependence on the continued services of our senior management and other key employees; the COVID-19 pandemic and its impact on our business, financial condition and results of operations including the impact of measures taken to contain the virus and the impact on the global economy and consumer spending on our merchants' and partners' ecosystem; payments processed through Shopify Payments, Shop Pay Installments, or payments processed or funds managed through Shopify Balance; our history of losses and our ability to maintain profitability; our potential failure to effectively maintain, promote and enhance our brand; serious errors or defects in our software or hardware; our potential inability to achieve or maintain data transmission capacity; activities of merchants or partners or the content of merchants' shops and our ability to detect and address unauthorized activity on our platform; evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations that may limit the use and adoption of our services; acquisitions and investments, including strategic investments; our ability to successfully scale, optimize and operate Shopify Fulfillment Network; risks associated with Shopify Capital, and offering financing to merchants; potential claims by third parties of intellectual property infringement or other third party or governmental claims, litigation, disputes, or other proceedings; our reliance on computer hardware, purchased or leased, software licensed from and services rendered by third parties, in order to provide our solutions and run our business, sometimes by a single-source supplier; the impact of worldwide economic conditions, such as economic impacts due to the Russian invasion of Ukraine, including the resulting effect on spending by small and medium-sized businesses or their buyers; manufacturing and supply chain risks; unanticipated changes in tax laws or adverse outcomes resulting from examination of our income or other tax returns; being required to collect federal, state, provincial or local business taxes, sales and use taxes or other indirect taxes in additional jurisdictions on transactions by our merchants; the interoperability of our platform with mobile devices and operating systems; changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers; our potential inability to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third parties from making unauthorized use of our technology; our pricing decisions for our solutions, including localized pricing for different markets; our use of open source software; seasonal fluctuations; exchange rate fluctuations that may negatively affect our results of operations; our dependence upon buyers’ and merchants’ access to, and willingness to use, the internet for commerce; provisions of our financial instruments including our notes; our potential inability to raise additional funds as may be needed to pursue our growth strategy or continue our operations, on favorable terms or at all; our tax loss carryforwards; the ownership of our shares; our sensitivity to interest rate fluctuations; and our concentration of credit risk, and the ability to mitigate that risk using third parties, and the risk of inflation; periodic variability in how compensation expense is allocated between cash and stock-based compensation due to compensation allocations by our employees under our new compensation system; and other one-time events and other important factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

1. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month.

2. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

3. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments.

4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, employee severance, expense related to legal contingencies, unrealized and realized gains and losses on equity and other investments, a real estate-related impairment charge and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information.

5. Prior period per share amounts have been adjusted to reflect the ten-for-one share split effected in June 2022.

Shopify Reports Third Quarter 2022 Financial Results.pdf